Background Paper #6

By Johnny West

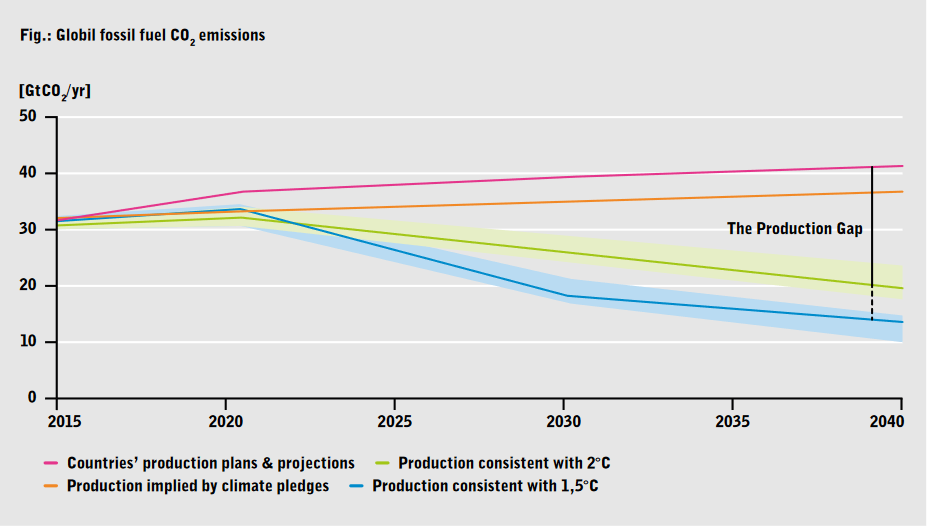

Effective climate action requires leaving vast amounts of fossil fuels in the ground. In contrast, the 2019 report The Production Gap (UNEP, 2019) demonstrated convincingly that countries across the world are planning the continued expansion of fossil fuel production.

Although fossil fuel development, in particular oil and gas, promised vast riches in the past, today it is exposing fossil fuel producers and their creditors to a massive stranded asset risk. Technological disruption with the rapid cost-reduction of renewable energy and storage technologies, in conjunction with the inevitability of increased climate action, are at the root of unprecedented uncertainties over the future of the sector.

This is particularly true for new, hitherto unexploited reserves, which on average require 10 years and massive upfront investment in infrastructure (pipelines, terminals) before the first oil begins to flow.

Nevertheless, the pressing needs of servicing debt and the prevailing mindset of associating fossil fuels with wealth may still push new producer countries into subsidising fossil fuel development and entering into risky contracts with oil and gas firms.

This paper proposes an innovative solution to this dilemma: a contract between international creditors and the government to leave certain hitherto undeveloped and unassigned oil and gas reserves in the ground for an initial 10-year period.

In exchange, a participating government would receive debt relief. The amount could be calculated based on traditional oil industry methods of asset evaluation, applying them to future revenue profiles of governments with potential oil and gas projects.

The urgency of the climate crisis requires thinking outside of the box. This proposal does so and merits wider discussion and consideration.

Published by Heinrich Böll Foundation, Center for Sustainable Finance (SOAS, University of London), and Boston University Global Development Policy Center as Background Paper to the Debt Relief for Green and Inclusive Recovery Project.