The Debt Relief for a Green and Inclusive Recovery (DRGR) Project produces rigorous, policy-oriented research centered on developing systemic approaches for resolving the debt crisis and advancing a just transition to sustainable, low-carbon economy. This includes flagship reports, policy briefs, working papers and more. For relevant commentary and summaries of the latest research, read our blog.

Explore our Latest Research

Giving Voice to The Silent Debt Crisis: How Debt Relief Can Unlock Green Growth Pathways for Africa

October 2024

Africa is amongst the most vulnerable regions in the world to the impacts of climate change, while also grappling with a severe sovereign debt crisis. A new policy brief by Bogolo Kenewendo, Patrick Njoroge and Alexander Dryden analyzes Africa’s debt dynamics and outlines a proposal to unlock the continent’s potential for green growth and support climate resilience.

Defaulting on Development and Climate – Debt Sustainability and the Race for the 2030 Agenda and Paris Agreement

April 2024

Time is running out to achieve the goals set out in the United Nations 2030 Agenda for Sustainable Development and the Paris Agreement. Not meeting these goals will have tragic impacts on the lives of present and future generations; yet, emerging market and developing economies (EMDEs) are facing conditions that inhibit their ability to mobilize investment, including historic levels of external debt, higher interest rates and low growth prospects to 2030. The report “Defaulting on Development and Climate – Debt Sustainability and the Race for the 2030 Agenda and Paris Agreement” performs an enhanced global external debt sustainability analysis (DSA) to estimate the extent to which EMDEs can mobilize the recommended levels of external financing without jeopardizing debt sustainability.

Debt Relief by Multilateral Lenders – Why, How and How Much?

September 2023

As the sovereign debt crisis in the Global South continues to unfold, the lack of involvement of multilateral development banks (MDBs) in debt relief efforts has become a contentious issue among major creditors. Although the Group of 20 (G20) has explicitly called for MDBs to develop options to share the burden of debt relief efforts, MDBs have not presented any concrete and systemic plan thus far on how to contribute to debt relief efforts to countries applying for the G20 Common Framework. The report “Debt Relief by Multilateral Lenders – Why, How and How Much?” aims to contribute to the ongoing debate over debt relief negotiations and MDBs in three main areas.

Africa’s Inconvenient Truth: Debt Distress and Climate-Resilient Development in Sub-Saharan Africa

August 2023

Due to multiple external shocks since the outbreak of the COVID-19 pandemic, sub-Saharan Africa (SSA) is facing acute debt distress and new highs in the cost of foreign capital. Concomitantly, the region needs to mobilize a stepwise level of financing to meet shared climate and development goals, under the Paris Agreement climate targets and the UN 2030 Sustainable Development Goals (SDGs). Do SSA countries have the fiscal space necessary to achieve the Paris Agreement commitments and SDGs while also servicing their external debt?

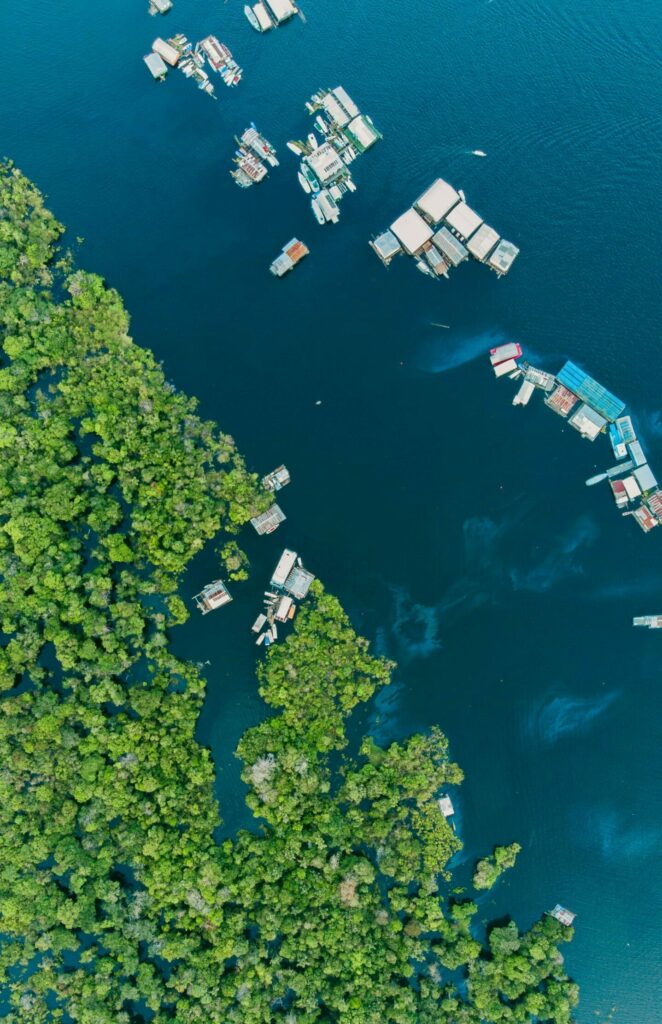

A Green Deal for the Amazon: Sovereign Sustainability-Linked Bonds

August 2023

As deforestation progresses at a torrid pace, countries in the Amazon region are increasingly vulnerable to climate change and its potential negative economic impacts. A new policy brief from Moritz Kraemer argues that tailored financial instruments can support incentives for conservation for both current and future governments in the Amazon region. Linking deforestation to debt service costs could create a clear financial incentive to policymakers to enforce national rules aimed at preventing deforestation.

Guaranteeing Sustainable Development

April 2023

The report “Guaranteeing Sustainable Development“ analyzes new data on the level and composition of public and private external sovereign debt for emerging markets and developing economies (EMDEs).

It estimates the size of debt restructuring and suspension necessary for the 61 EMDEs in or at high risk of debt distress to achieve debt sustainability and put them on a path towards meeting their development goals and climate commitments.

In all, urgent action is needed to immediately help EMDEs restore debt sustainability and mobilize resources to achieve shared development and climate change goals. The G20 Common Framework needs immediate reform to provide debt relief for a green and inclusive recovery.

Another Lost Decade or a Decade of Action?

April 2023

Climate-related shocks are becoming more frequent and severe. More than ever, countries must invest in climate resilience and just transitions, but for many emerging market and developing economies (EMDEs), high debt burdens put achieving climate and development goals out of reach.

Will the 2020s be a decade of action to achieve shared climate and development goals, or will it amount to another lost decade of development?

This policy brief by Marina Zucker-Marques and Ulrich Volz explains the proposal advanced by the Debt Relief for Green and Inclusive Recovery (DRGR) Project.