High-level Event at the IMF/World Bank Annual Meetings 2025

The global sovereign debt landscape is increasingly defined by geopolitical fragmentation, which is reshaping economic growth and stability through trade disruptions, volatile capital flows, and shifting investment decisions. For many economies—particularly in the Global South—these dynamics translate into shrinking fiscal space and higher borrowing costs. At the same time, developing countries must cope with the rising costs of climate shocks while mobilizing resources for decarbonization and adaptation. Yet, heavy debt burdens constrain their ability to attract both public and private investment. In this context, calls for reforming the international financial architecture have multiplied but have yet to produce meaningful change.

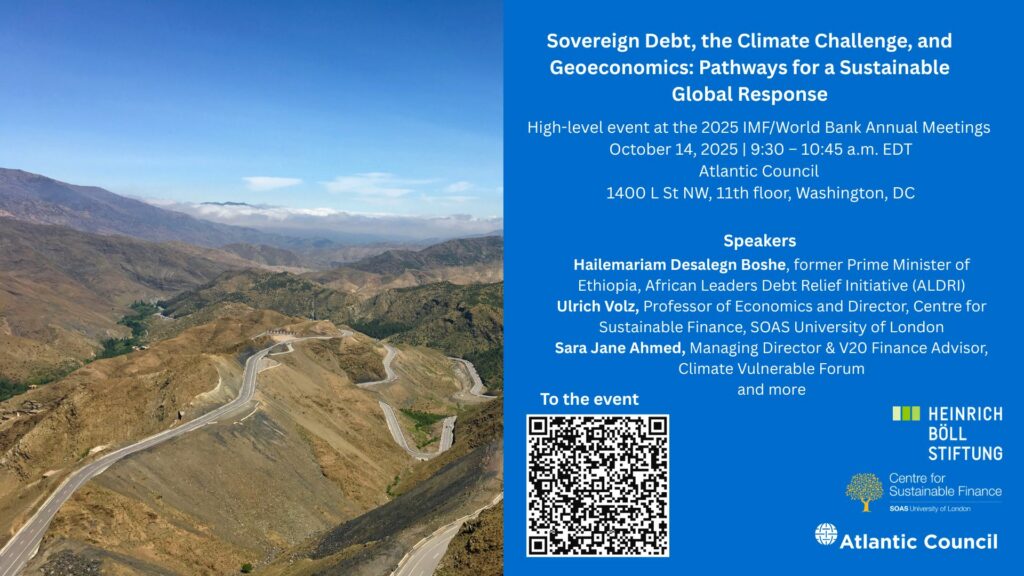

Taking place on the sidelines of the 2025 IMF/World Bank Annual Meetings the Atlantic Council, the Heinrich Böll Foundation, and the SOAS Centre for Sustainable Finance will convene a high-level event at the sidelines of the 2025 International Monetary Fund (IMF)/World Bank Annual Meetings to explore how geoeconomics, debt sustainability, and climate vulnerability intersect—and to identify pathways for cooperative, sustainable responses amid global fragmentation.

Recording of the Event:

Speakers:

- Hailemariam Desalegn Boshe, former Prime Minister of Ethiopia and Member, African Leaders Debt Relief Initiative (ALDRI)

- Ulrich Volz, Professor of Economics and Director, Centre for Sustainable Finance, SOAS University of London

- Sara Jane Ahmed, Managing Director and V20 Finance Advisor, Climate Vulnerable Forum

Moderator: Nicole Goldin, Senior Fellow, Atlantic Council

Welcome Remarks: Josh Lipsky, Director, Atlantic Council Geoeconomics Center

Date & Time

October 14, 2025 | 9:30 – 10:45 a.m. EDT

Location

Atlantic Council, 1400 L St NW, 11th floor, Washington, DC