By Ulrich Volz, Shamshad Akthar, Kevin Gallagher, Stephany Griffith-Jones and Jörg Haas

To enable a green and socially just recovery for all countries, public debt problems need to be urgently addressed so that all governments have the fiscal space to finance crucial health and social spending and invest in a green and inclusive recovery.

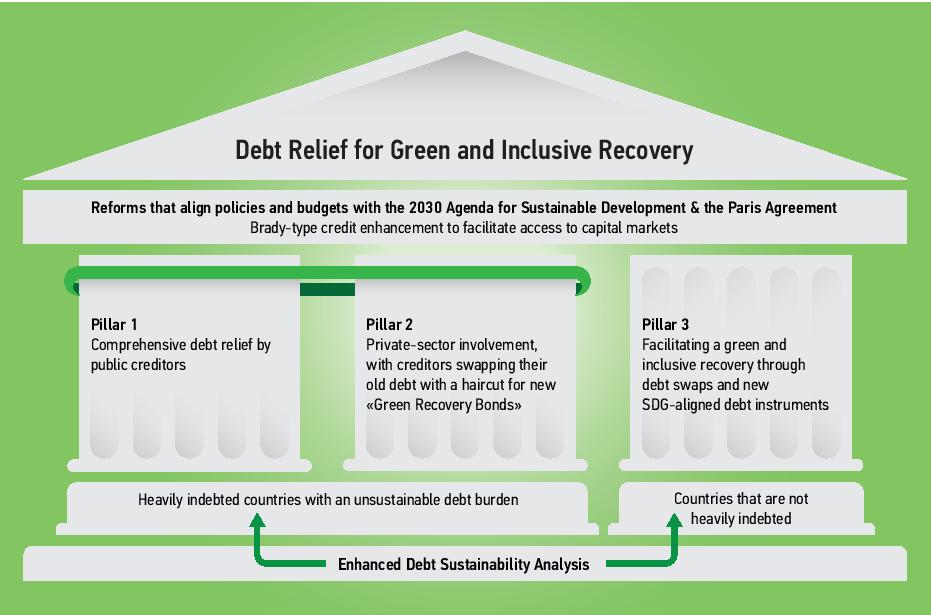

We propose a Debt Relief for Green and Inclusive Recovery Initiative as an ambitious, concerted, and comprehensive debt relief initiative – to be adopted on a global scale – that frees up resources to support recoveries in a sustainable way, boosts economies’ resilience, and fosters a just transition to a low-carbon economy.

Eligibility should be a function of debt sustainability, which should be determined in a Debt Sustainability Assessment carried out by the International Monetary Fund (IMF) and the World Bank, with inputs from other institutions. Debt Sustainability Assessments need to

be based on realistic assumptions and account for climate risks.

If a Debt Sustainability Assessment asserts that the sovereign debt of a country is of significant concern, the G20 should coordinate with all bilateral and multilateral creditors about a debt restructuring, and the IMF should make its programs conditional on a sovereign debt restructuring involving private creditors.

Governments receiving debt relief would need to commit to reforms that align their policies and budgets with the 2030 Agenda for Sustainable Development and the Paris Agreement. Our proposal consists of three pillars and aims at achieving maximum creditor and debtor participation.

Pillar 1: Comprehensive debt relief for eligible heavily indebted countries by public creditors that is analogous to, but improves upon the HIPC Initiative.

Pillar 2: Private-sector involvement, with private creditors swapping their old debt holdings with a haircut for new Green Recovery Bonds.

Pillar 3: Debt-for-climate or debt-for-sustainability swaps for countries that are not heavily indebted, but have reduced fiscal space due to Covid-19.

Any new debt issued by countries participating in the Debt Relief for Green and Inclusive Recovery Initiative could receive Brady-type credit enhancement, which would help countries to continue to have access to international capital markets.

This proposal goes further than the new common framework endorsed by the G20 and Paris Club, as it would ask for mandatory participation from the private sector. Second, it would include middle-income countries with unsustainable debt burdens. Thirdly, the proposed Debt Relief for Green and Inclusive Recovery Initiative is geared toward achieving the Paris Agreement on climate change and the 2030 Agenda for Sustainable Development, which the common framework is not.

Propuesta

Alivio de la deuda para una recuperación verde e inclusiva

Con el propósito de permitir una recuperación ecológica y socialmente justa para todos los países, resulta necesario abordar urgentemente los problemas de la deuda pública para que todos los gobiernos tengan el espacio fiscal necesario para financiar gastos sanitarios y sociales cruciales e invertir en una recuperación ecológica e inclusiva. Descargue la propuesta aquí.

The proposal was published by the Heinrich Böll Stiftung, the Center for Sustainable Finance at SOAS, University of London and Boston University Global Development Policy Center in November 2020.