By Ulrich Volz, Shamshad Akhtar, Kevin P. Gallagher, Stephany Griffith-Jones, Jörg Haas, and Moritz Kraemer

In November 2020, we put forward a proposal for Debt Relief for a Green and Inclusive Recovery – a call for an ambitious, concerted, and comprehensive debt relief initiative that should be adopted on a global scale to free up resources to support recoveries in a sustainable way, boost economies’ resilience, and foster a just transition to a low-carbon economy.

We have argued that the option for debt relief should not only apply

to low-income countries – as is the case with the Common Framework – but also to middle-income countries that have been hit hard by the pandemic, with dramatic increases in extreme poverty.

Importantly, our proposal has highlighted the importance of linking debt restructuring with the need to build resilience and a commitment by creditors and debtor countries alike to align newfound fiscal space with globally agreed climate and development goals.

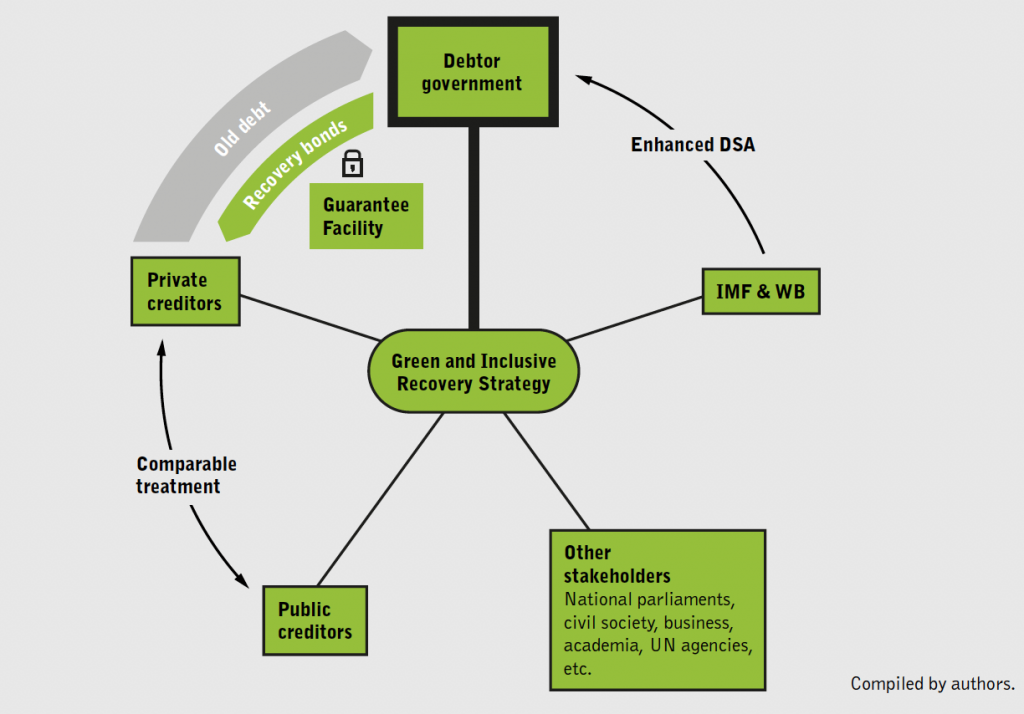

In this report, we develop this proposal further. The Common Framework urgently needs to be enhanced to allow for comprehensive debt relief that is oriented around a green, inclusive recovery. To that end, we suggest the following amendments.

First, instead of waiting for countries to come forward and apply for debt relief individually, the Framework should recognise that a systemic crisis demands a systemic solution. The G20 should encourage all low- and middle-income countries whose debt is considered unsustainable to participate in a comprehensive debt restructuring. And when assessing debt burdens, the analysis must include climate and other sustainability risks – including stranded asset risks – as well as estimates of a country’s financing needs for climate-change adaptation, mitigation, and achieving the broader goals set out in the 2030 Agenda for Sustainable Development.

Equally important, governments receiving debt relief would commit to reforms that align their policies and budgets with Agenda 2030 and the Paris Agreement. Some portion of the restructured repayments will be channelled into a Fund for Green and Inclusive Recovery (or an already existing national fund that could be used for this purpose) that can be used by the government for investment in SDG-aligned spending. The government would be free to decide how to spend the money from this Fund, as long as it is demonstrably helping a green and inclusive recovery and contributes to achieving the SDGs.

Moreover, the Framework needs to incorporate adequate incentives to ensure that private creditors participate and bear a fair share of the burden. If an enhanced Debt Sustainability Analysis (DSA) asserts that a country’s sovereign debt is of significant concern, the IMF should make its programs conditional on a restructuring process that includes private creditors. Here, Brady-type credit enhancements for new bonds that would be swapped for old debt with a significant haircut would facilitate debt relief negotiations with private creditors. To this end, we propose a Guarantee Facility for Green and Inclusive Recovery managed by the World Bank. If payments on the new bonds are missed, the collateral would be released to the benefit of private creditors, and the missed payments would have to be repaid by the sovereign to the Guarantee Facility.

Seven months after releasing the Common Framework, not a single restructuring (or debt «treatment», as the Common Framework calls it) has been concluded, notwithstanding a deepening crisis in several eligible countries. We consider this to be strong evidence that the crisis architecture needs further development. The G20 Common Framework for Debt Treatments will not suffice to tackle the debt problem facing many developing and emerging economies. This is a systemic problem, and a global and systemic response is needed. The international community, and the G20 in particular, need to agree on an ambitious agenda for tackling debt crises and providing countries with the fiscal space for sustainable crisis responses.

The report was published by the Heinrich Böll Stiftung, the Center for Sustainable Finance at SOAS, University of London and Boston University Global Development Policy Center in June 2021.