A debt crisis is emerging in the Global South at the precise moment when substantial investment is needed to meet shared climate and development goals. Yet, the G20 Common Framework has been unable to engage all creditor classes or link debt relief to climate and development.

How can emerging market and developing economies (EMDEs) find financial and fiscal stability while making the investments necessary to transition to sustainable and low-carbon economies? How does climate vulnerability impact a country’s debt sustainability? What level of restructuring is required across creditor classes for debt distressed EMDEs to achieve debt sustainability? And how could the G20 Common Framework be reformed to provide debt relief for a green and inclusive recovery?

A new report by Luma Ramos, Rebecca Ray, Rishikesh Ram Bhandary, Kevin P. Gallgher and William N. Kring for the Debt Relief for a Green and Inclusive Recovery (DRGR) Project analyzes new data on the level and composition of public and private external sovereign debt for EMDEs. It estimates the size of debt restructuring and suspension necessary for the 61 EMDEs in or at high risk of debt distress to achieve debt sustainability and put them on a path towards meeting their development goals and climate commitments.

The DRGR Project is a collaboration between the Boston University Global Development Policy Center, Heinrich-Böll-Stiftung and the Centre for Sustainable Finance at SOAS, University of London that argues it is time for comprehensive debt reform. Utilizing rigorous research, the DRGR Project seeks to develop systemic approaches to both resolve the debt crisis and advance a just transition to a sustainable, low-carbon economy in partnership with policymakers, thought leaders and civil society around the world.

Main findings:

- EMDE sovereign debt levels are increasing: EMDE external debt levels and service payments have more than doubled since the 2008 global financial crisis. Between 2008-2021, EMDE sovereign debt increased by 178 percent, from $1.4 trillion to $3.6 trillion.

- Climate vulnerable countries have some of the most significant debt distress: Higher climate vulnerability correlates with lower sovereign borrowing space and high debt service payments against exports.

- For 61 countries identified as in or at high risk of debt distress to achieve debt sustainability, more than $812 billion in debt needs to be restructured across all creditor classes. Using a range of historical precedents for the size of relief needed, the authors estimate that public and private creditors will have to grant haircuts between $317 billion to $520 billion in debt relief.

- Between $37.1 billion to $61.9 billion is needed to fund a guarantee facility. The DRGR Project proposes the creation of such a facility to provide enhancements for newly issued ‘green and inclusive recovery’ Brady bonds that private and commercial creditors can swap with a significant haircut against old debt.

- At least $30 billion in debt should be suspended over the next five years for the most debt distressed countries. The suspension would give debt distressed countries fiscal breathing room and work to compel reluctant creditors to come to the negotiating table. This estimate is meant to illustrate the scale of suspension potentially needed to provide debt distressed countries breathing room, while negotiating a larger and more ambitious restructuring effort.

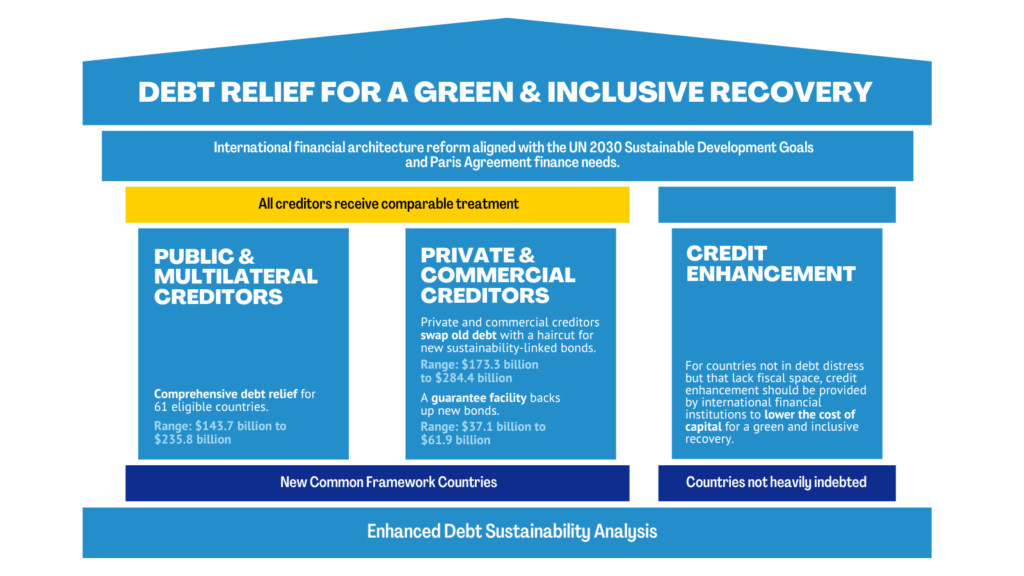

The DRGR Project has developed a proposal that is in many ways a modern-day version of the Brady Plan and the Highly Indebted Poor Countries (HIPC) Initiative of the 1990s combined. The DRGR proposal consists of three pillars, illustrated in Figure 1 and explained below:

Figure 1: Three Pillars for Debt Relief for a Green and Inclusive Recovery

Note: The ranges of the haircuts mentioned in the figure are in net present value terms.

- Public creditors should grant significant debt reductions that not only bring a distressed country back to debt sustainability but put the country on a path to achieving development and climate goals—in a manner that preserves the preferred creditor status and AAA credit ratings for participating international organizations.

- Private bondholders and commercial creditors should grant a commensurate debt reduction with public creditors. These creditors would be compelled to enter negotiations through Brady bonds backed by a guarantee fund and a payments standstill.

- For countries not in debt distress but that lack fiscal space, credit enhancement should be provided by international financial institutions to lower the cost of capital for a green and inclusive recovery.

In all, urgent action is needed to immediately help EMDEs restore debt sustainability and mobilize resources to achieve shared development and climate change goals. The G20 Common Framework needs immediate reform to provide debt relief for a green and inclusive recovery.