In the Global South, a silent sovereign debt crisis is unfolding. High external debt levels and burdensome debt servicing in many low- and middle-income countries are hindering crisis response efforts, weakening development and growth prospects, and undermining the capacity to adapt to the climate crisis. This growing debt burden also jeopardizes the achievement of the Sustainable Development Goals (SDGs), with severe human consequences.

The G20 Common Framework for Debt Treatments approach of case-by-case debt treatment has shown insufficient to tackle the debt problem facing many developing and emerging economies. As the debt crisis is a systemic problem, it requires a comprehensive and systemic response. The international community, and the G20 in particular, need to agree on an ambitious agenda for tackling the debt crisis and providing countries with the fiscal space for sustainable crisis responses.

The Boston University Global Development Policy Center, Heinrich-Böll-Stiftung, and the Centre for Sustainable Finance at SOAS, University of London founded the Debt Relief for Green and Inclusive Recovery (DRGR) Project in 2020 during the height of the COVID-19 pandemic. Heinrich-Böll-Stiftung and the Centre for Sustainable Finance at SOAS, University of London remain active contributors.

The DRGR Project works with policy makers, thought leaders and civil society from around the world to develop systemic approaches to both resolve the debt crisis and advance a just transition to sustainable, low-carbon economy.

What is THE DRGR PRoPOSAL?

The DRGR proposal is a comprehensive approach to tackle sovereign debt challenges while advancing climate resilience and sustainable development.

The DRGR proposal offers a set of incentives and sticks to ensure that all creditor classes participate in the restructuring and relief process. By distinguishing between countries facing debt distress and those with liquidity constraints, it provides tailored solutions that empowers nations to pursue sustainable green growth pathways and achieve their climate and development goals.

The DRGR proposal is built on three key components:

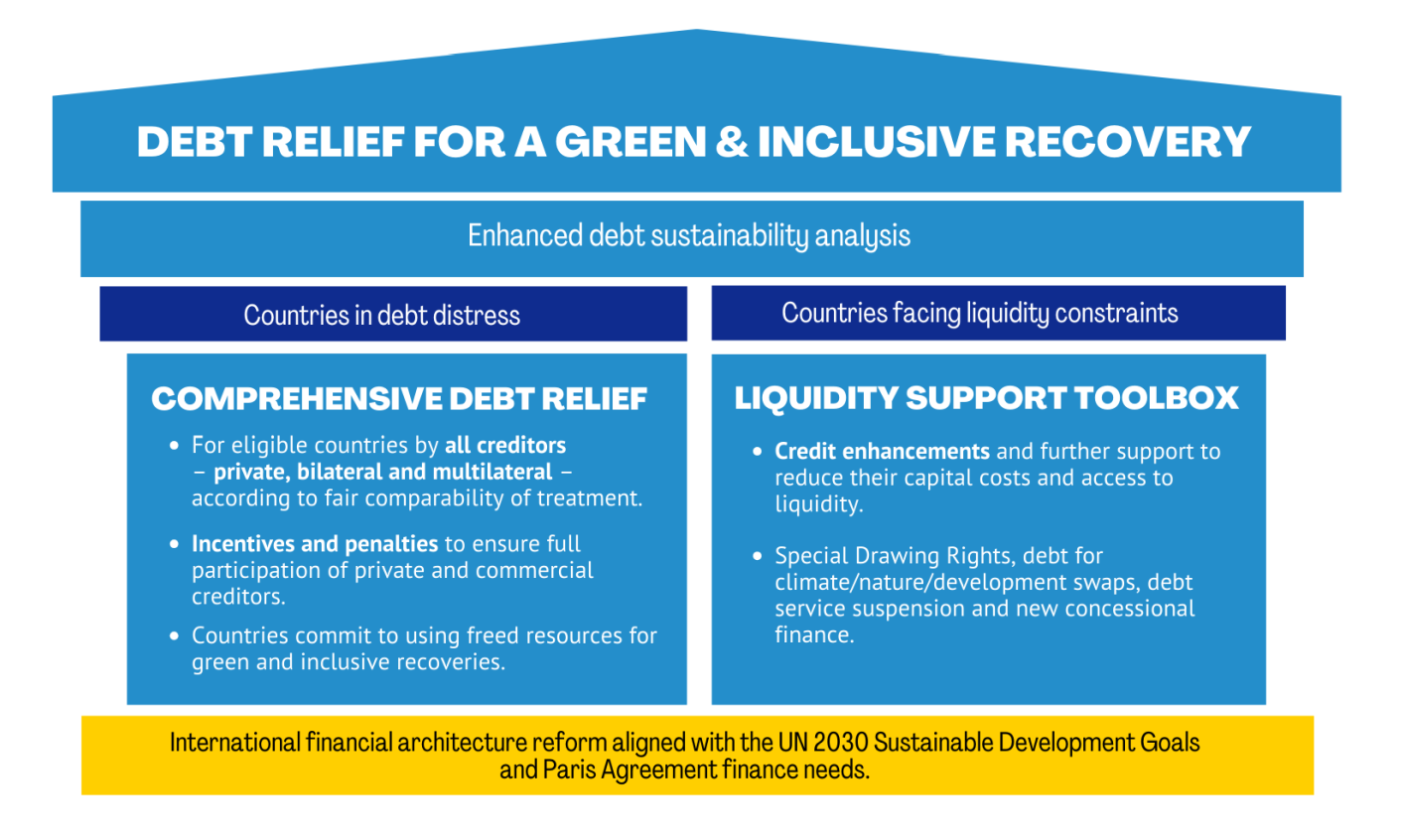

- The bedrock of DRGR proposal, as shown in figure 1, is a comprehensive and speedy reform of the debt sustainability analysis (DSA) framework to incorporate climate risks and critical investment needs for achieving the Sustainable Development Goals (SDGs) and climate targets. Current DSAs focus on a country’s capacity to service debt but overlook the need for investment in climate resilience and just transitions. By integrating climate considerations, the international community can align debt relief with sustainability goals and better differentiate between countries requiring debt relief and those needing liquidity support.

After an enhanced DSA is performed, the DRGR is based on two pillars (as shown in figure 1) to address specific needs of countries in need of debt relief, and those in need of liquidity support.

- For the group of countries in need of debt restructuring and relief, meaningful debt relief needs to be provided. The participation of all creditor classes, including private bondholders and MDBs, in debt restructuring is critical. Fair comparability of treatment rules to determine haircuts are needed to ensure equitable burden-sharing. Incentives and penalties are required to safeguard private and commercial creditors’ full participation in debt restructuring. Debt relief must also be paired with fresh concessional financing to enable sustainable recoveries. In return, countries receiving debt relief must commit to using freed fiscal resources for green and inclusive development, in alignment with their Nationally Determined Contributions and national implementation plans for the SDGs. These countries must also ensure full public debt transparency and adopt enhanced public debt standards.

- Non-distressed countries facing liquidity constraints should be provided with credit enhancements and further support to reduce their capital costs and access to liquidity. Besides the issuance of new Special Drawing Rights (SDR) and the rechannelling of SDRs from advanced countries, efforts need to be reinforced to provide new concessional finance by MDBs. Instruments like debt buybacks, debt for climate/nature/development swaps, and credit enhancements for new sovereign sustainability linked bonds can complement this.

Debt relief alone is not a substitute for a permanent sovereign debt workout mechanism and the deeper reforms needed to reform the global financial architecture. It should be provided as part of a package of new liquidity and affordable development finance, alongside reforms to the global financial architecture.

Figure 1: Two Pillars for Debt Relief for a Green and Inclusive Recovery

Find answers to frequently asked questions on the debt crisis, the DRGR proposal and how to guarantee sustainable development.

THE DRGR PROPOSAL EXPLAINED

Video: Sovereign Debt Relief for Climate Vulnerable Countries

November 2024

Developing countries are trapped in a vicious cycle of debt, climate change and underinvestment. As they spend more on debt interest than on healthcare, education, or climate resilience, the human costs are severe. The Debt Relief for a Green and Inclusive Recovery Project offers a bold solution: transformative debt relief to support sustainable development and climate action. It’s time to break the cycle and build a resilient, green and equitable global economy.

Now is the time for action. Learn more in our video.

Policy Brief: Another Lost Decade or a Decade of Action?

April 2023

Climate-related shocks are becoming more frequent and severe. More than ever, countries must invest in climate resilience and just transitions, but for many emerging market and developing economies (EMDEs), high debt burdens put achieving climate and development goals out of reach.

Will the 2020s be a decade of action to achieve shared climate and development goals, or will it amount to another lost decade of development?

This policy brief by Marina Zucker-Marques and Ulrich Volz explains the proposal advanced by the Debt Relief for Green and Inclusive Recovery (DRGR) Project.

Video: Explaining the Debt Relief for a Green and Inclusive Recovery Proposal

November 2023

The countries of the Global South have contributed little to climate change. But they are particularly vulnerable to its impacts. Now, as a result of COVID-19, high interest rates and climate-related disasters, debt levels in the Global South have skyrocketed. As a consequence, a triple crisis of debt, climate change and lost development is emerging. How can highly indebted developing countries respond to these challenges?

This video explains how the DRGR proposal would work. In less than three minutes.

fLAGSHIP REPORTS

Defaulting on Development and Climate – Debt Sustainability and the Race for the 2030 Agenda and Paris Agreement

April 2024

Time is running out to achieve the goals set out in the United Nations 2030 Agenda for Sustainable Development and the Paris Agreement. Not meeting these goals will have tragic impacts on the lives of present and future generations; yet, emerging market and developing economies (EMDEs) are facing conditions that inhibit their ability to mobilize investment, including historic levels of external debt, higher interest rates and low growth prospects to 2030. The report “Defaulting on Development and Climate – Debt Sustainability and the Race for the 2030 Agenda and Paris Agreement” performs an enhanced global external debt sustainability analysis (DSA) to estimate the extent to which EMDEs can mobilize the recommended levels of external financing without jeopardizing debt sustainability.

Guaranteeing Sustainable Development

April 2023

The report “Guaranteeing Sustainable Development“ analyzes new data on the level and composition of public and private external sovereign debt for emerging markets and developing economies (EMDEs). It estimates the size of debt restructuring and suspension necessary for the 61 EMDEs in or at high risk of debt distress to achieve debt sustainability and put them on a path towards meeting their development goals and climate commitments.

Securing Private-Sector Participation and Creating Policy Space for Sustainable Development

June 2021

The report “Securing Private-Sector Participation and Creating Policy Space for Sustainable Development” updates our proposal with more details on how countries can develop their green and inclusive recovery strategies, and how the private sector can be induced to participate in debt reduction.

Debt Relief for a Green and Inclusive Recovery

November 2020

The proposal “Debt Relief for Green and Inclusive Recovery” published by the Heinrich Böll Stiftung, the Center for Sustainable Finance at SOAS, University of London and Boston University Global Development Policy Center suggests that low and middle-income countries with unsustainable debt burdens receive substantial debt relief by public and private creditors, in order to provide fiscal space for investment in Covid-19-related health and social spending, climate adaptation and green economic recovery strategies. Private creditors participating in the debt restructuring would swap their old debt holdings with a haircut for new “Green Recovery Bonds”. (Spanish translation available)