To address climate change and meet the United Nations 2030 Sustainable Development Goals, emerging market and developing economies (EMDEs), excluding China, need to mobilize an estimated $3 trillion annually. However, these nations face fiscal constraints exacerbated by the COVID-19 pandemic, capital flight, and rising borrowing costs. The new Sovereign Debt and Environment Profiles (SDEP) database from Boston University’s Global Development Policy Center (GDP Center) examines these fiscal constraints and green investment opportunities in 114 EMDEs, bridging the research findings of the DRGR project and the GDP Center.

By Rebecca Ray and Jörg Haas

Without a stepwise injection of capital into developing countries, meaningful progress on addressing climate change and meeting the United Nations 2030 Sustainable Development Goals (SDGs) and the Paris Agreement targets will remain out of reach. The Group of 20 (G20) Independent Experts Group estimates that emerging market and developing economies (EMDEs) excluding China need to mobilize $3 trillion per year, with $1 trillion coming from international sources and another $2 trillion mobilized domestically.

Yet, the countries most in need of climate and biodiversity finance are also fiscally constrained, a problem that has been exacerbated by the response to COVID-19 pandemic, subsequent capital flight, monetary tightening in advanced countries as well as the dollar strengthening. In fact, many EMDEs have net negative flows, meaning that more money is leaving these countries – primarily to the Global North – than flowing in. In some cases, countries urgently need access to affordable finance while others are already facing unsustainable debt burdens and require comprehensive debt relief.

These burdens can create a vicious cycle where fiscal constraints jeopardize long-term environmental commitments, which in turn make developing economies more vulnerable to the extreme weather events linked to climate change, further exacerbating the underlying fiscal constraints. To replace this vicious cycle with a virtuous cycle built on resilience and sustainable growth, developing countries must have fiscal space to make necessary investments in climate and nature.

The Sovereign Debt and Environment Profiles (SDEP) Database, a new interactive database from the Boston University Global Development Policy Center (GDP Center), explores the fiscal constraints and green investment opportunities of 114 EMDEs. It shows each country’s external debt stock and near-term repayment schedule by creditor and classifies each country’s climate investment needs and biodiversity investment opportunities in four ways:

- Climate change adaptation: The extent to which each country is vulnerable to the effect of extreme weather events linked to climate change, including through impacts to food, water, health, ecosystem services, human habitat and infrastructure.

- Climate change mitigation: The extent to which each country’s energy trajectory needs investment if it is to become compatible with the goal of limiting catastrophic climate change.

- Land conservation: The extent to which each country’s system of national protected areas can effectively be expanded through additional land conservation investment.

- Marine conservation: The extent to which each country’s system of marine protected areas can effectively be expanded through additional marine conservation investment.

Bridging existing research

The SDEP Database bridges and visualizes data from two recent research publications. First, a recent report from GDP Center researchers explores these four environmental variables for climate and biodiversity investment, demonstrating that countries with greatest green investment opportunities and needs are disproportionately burdened with unsustainable debt levels and repayment schedules, jeopardizing their ability to make these needed investments.

These findings are further supported by a new report from the Debt Relief for a Green and Inclusive Recovery (DRGR) Project which provides an enhanced debt sustainability analysis (DSA) for 66 countries that are considered low-income countries by the International Monetary Fund (IMF). The report finds that debt relief is urgently needed for at least 47 economically vulnerable EMDEs to maintain debt sustainability while investing in shared climate and development goals.

Using the methodology and enhanced DSA from the DRGR Project report, the SDEP Database considers each of the following three groups of countries independently:

- Low-income Countries in Need of Debt Relief: These 47 countries have been identified, per the enhanced DSA, as needing debt relief to meet the SDGs and climate investment needs in the next five years.

- Low-income Countries in Need of Liquidity: These 19 countries have not been identified as needing debt relief, but they still face high costs of capital and need liquidity support.

- Market Access Countries: These 48 countries are out of scope of analysis of DRGR Project report, but they may still face capital market constraints due to the high cost of capital.

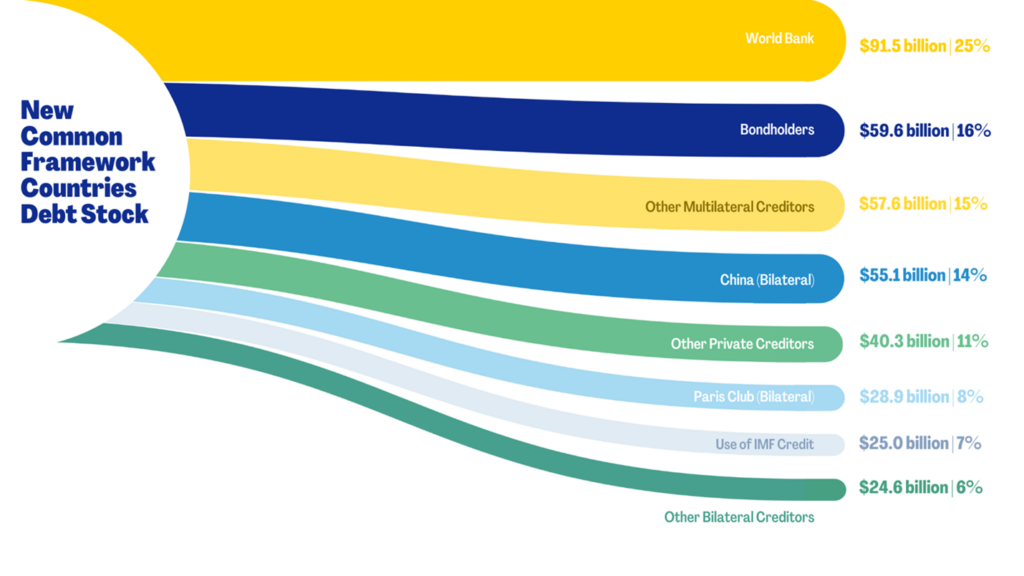

The 47 low-income countries in need of debt relief collectively owe $383 billion in nominal debt (including borrowing from the IMF), and the creditor breakdown is illustrated in Figure 1. The largest share of this debt is owed to multilateral creditors ($91.5 billion to the World Bank and $57.6 billion to other multilateral creditors), followed by private creditors ($59.6 billion to bondholders and $40.3 billion to other private creditors), China ($55.1 billion), Paris Club ($28.9 billion), the IMF ($24.9 billion) and other official bilateral creditors ($24.5 billion). The DRGR report recommends a “New Common Framework” for debt restructuring with these 47 countries.

Figure 1: Nominal debt stock of low-income countries in need of debt relief, by creditor group, 2022

Policy recommendations

The SDEP Database reveals, and underscores, three key policy recommendations. First, the diverse creditor landscape seen in Figure 1 highlights the need for the participation of all creditor classes in debt relief efforts. While the World Bank is the top holder of debt for the 47 New Common Framework countries, bondholders and China are also crucial creditors, each with important roles to play.

Secondly, joint negotiations across different classes of creditors should include fair comparability of treatment that considers the varying levels of concessionality in their debt. For example, debt to multilateral development banks (MDBs) has an average grant element that is roughly double the grant element of debt to China, while debt to private creditors has a negative average grant element. The burden that falls on creditors in debt restructuring should be distributed in such a way that recognizes the higher rate of return that private creditors have already received through higher interest rates.

Finally, the wide array of fiscal situations presented by developing countries requires a flexible menu of options, including a “New Common Framework” for the 47 countries with unsustainable debt levels, and a combination of new concessional finance and credit enhancement for all developing countries and emerging markets.

By clearly visualizing environmental investment needs against existing fiscal constraints, the SDEP Database aims to help policymakers, civil society and scholars gain a deeper understanding of which countries present green investment needs and opportunities, which countries will need debt relief in order to reach those goals, and which creditors are most important for each case’s negotiations.

As 2030 draws ever nearer, nations face increasing pressure to work toward their climate, biodiversity and sustainable development targets. For EMDEs in particular, who face the highest costs of climate change and biodiversity loss, as well as steep debt burdens and borrowing costs in addressing those risks, it is crucial for all creditors to play constructive roles in mobilizing capital for shared goals for a livable planet.