Africa is amongst the most vulnerable regions in the world to the impacts of climate change, while also grappling with a severe sovereign debt crisis. Our new new policy brief analyzes Africa’s debt dynamics and outlines a proposal to unlock the continent’s potential for green growth and support climate resilience.

By Patrick Njoroge, Bogolo Kenewendo and Alexander Dryden

Africa stands at a critical crossroads.

The continent is amongst the most vulnerable regions in the world to the impacts of climate change, while also grappling with a severe sovereign debt crisis. The external sovereign debt of African nations has nearly tripled between 2008-2022 and the intertwined challenges of climate vulnerability and unsustainable debt threaten to derail Africa’s development trajectory.

In our new policy brief published by the Debt Relief for a Green and Inclusive Recovery (DRGR) Project, we outline a proposal for immediate debt relief for African nations that would improve their fiscal capacity to address the climate emergency and embark on a sustainable growth pathway. Alongside debt relief, we argue for urgent reform of the International Monetary Fund (IMF)’s Debt Sustainability Analyses (DSA), as well as the broader international financial architecture, to more directly consider climate considerations and encourage greater investment into projects enhancing climate change resiliency.

The climate crisis and Africa’s debt burden

While the climate crisis threatens much of the Global South, Africa is particularly vulnerable. According to the Notre Dame Global Adaptation Initiative (ND-GAIN) index, 17 of the 20 countries most at risk from climate change are located on the continent. The impacts of extreme weather events, rising temperatures and changing precipitation patterns are already being felt, exacerbating food insecurity, displacing communities and threatening the region’s economic stability.

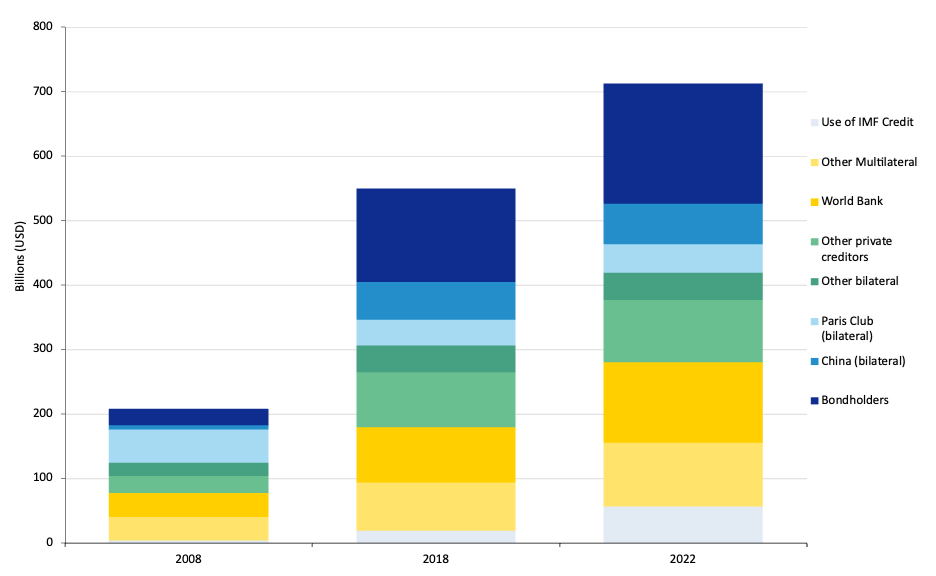

Concomitantly, Africa’s sovereign debt has ballooned to unsustainable levels. As Figure 1 shows, the External Public and Publicly Guaranteed (PPG) debt of African nations has risen by 240 percent between 2008-2022, driven by a series of external shocks including the COVID-19 pandemic, global inflation and interest rate hikes by advanced economies. Some countries such as Senegal, Rwanda, Mozambique and Ethiopia are experiencing a tenfold increase in their external sovereign debt levels.

Surging debt levels have placed an enormous fiscal strain on African nations. African governments will spend a staggering $163 billion on servicing debt, a sharp increase from the $61 billion spent in 2010. Such elevated interest payments to overseas creditors diverts valuable resources out of the domestic economy and away from key social and development areas, with over half of African nations spending more on servicing their debt than on critical sectors like healthcare in 2024.

Figure 1: The Public External Debt Composition (in USD billions) by Creditor Type for African Nations, 2008-2022

Given the recent rise in international borrowing costs, the debt outlook for African nations is also troubling. Since 2020, four African nations have defaulted, and the number of regional economies effectively barred from international capital markets has grown from one in 2010 to 11 in 2024. In response, some countries have resorted to rolling over debt at unsustainable interest rates, with Kenya and Cameroon issuing debt at yields exceeding 10 percent in 2024. In 2025, nine countries, including Egypt, Nigeria and Tunisia, face $7.5 billion in maturing foreign currency bonds, likely at significantly higher borrowing cost.

Moreover, the financial requirements for implementing African countries’ Nationally Determined Contributions (NDCs) underscore the pressing debt challenges facing the continent. To meet these climate goals, Africa will require approximately $2.8 trillion between 2020-2030. However, only about 10 percent of this funding is expected to come from domestic public resources, while the remaining 90 percent must be sourced externally.

This reliance on external funding further emphasizes the critical importance of comprehensive debt relief and increased concessional financing to enable African nations to achieve their climate and development objectives.

Who Needs Debt Relief?

While international efforts have primarily concentrated on providing liquidity to alleviate fiscal pressures, this approach fails to address the fundamental causes of Africa’s economic challenges. Though additional liquidity may offer temporary relief, it does not tackle the structural issues that perpetuate the continent’s debt crisis. To break free from this cycle and achieve meaningful progress towards achieving the United Nations 2030 Sustainable Development Goals (SDGs) and climate objectives, African countries require comprehensive debt relief.

Unfortunately, the international community lacks the proper tools to accurately assess which countries need debt relief and the extent of such relief.

Current debt relief mechanisms, such as the Group of 20 (G20) Common Framework, have proven inadequate, often characterized by their sluggish pace and insufficiency. Additionally, the reluctance of private creditors to participate in debt restructuring, coupled with the exclusion of multilateral development banks (MDBs) from these processes, results in ineffective and unequal debt relief efforts.

The DRGR Project’s 2024 report sought to address the shortcomings of the IMF’s DSA framework by developing an enhanced global DSA that accounts for the external financing needs related to development and climate change, aligned with the recommended levels set by the Independent Expert Group to the G20.

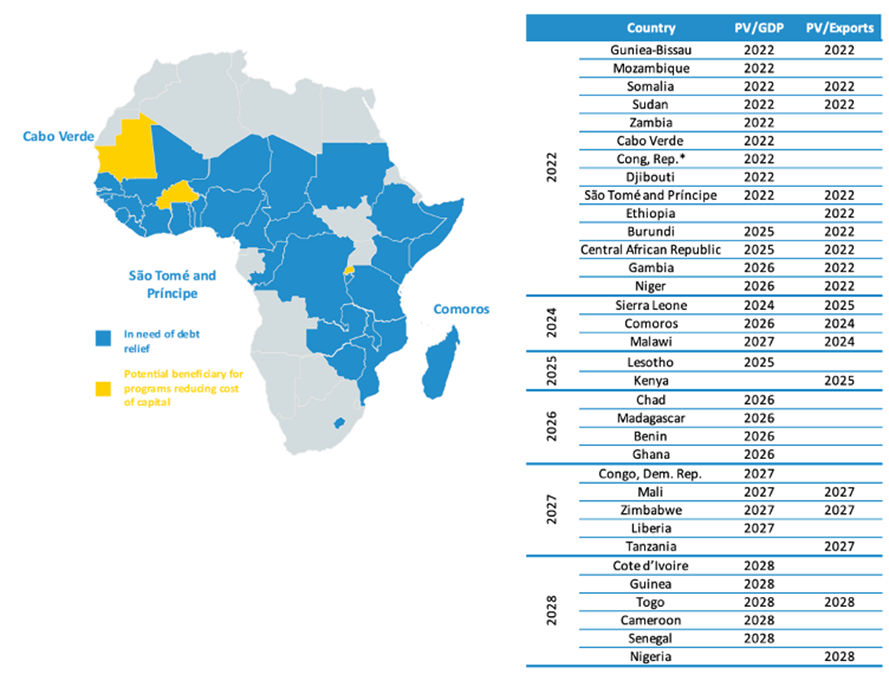

As shown in Figure 2, the enhanced DSA reveals that at least 34 African countries require significant debt relief to create the fiscal space necessary for green growth initiatives. Furthermore, three African nations—Rwanda, Burkina Faso and Mauritania—were identified as lacking the liquidity and fiscal space for climate and development investments, making it impossible for them to finance these essential investments without credit enhancement or liquidity support.

Figure 2: External Debt Sustainability Analysis Results Under Baseline Scenario: Countries Breaching Solvency Thresholds by Year

High debt servicing costs crowd out essential investments in climate adaptation and resilience, exacerbating the continent’s exposure to climate risks. This, in turn, leads to greater economic instability and further debt accumulation, trapping African nations in a seemingly unbreakable cycle of underinvestment and escalating vulnerability. However, as shown in Figure 3, if a successful program of debt relief and reforms can be achieved, it could trigger a positive green growth cycle for African nations.

Figure 3: The Positive Cycle of Green Growth

The DRGR Proposal: A Sustainable Pathway Forward

To address these challenges, the DRGR Project’s proposal provides a comprehensive approach to debt relief, integrating climate and development goals into debt restructuring processes. The DRGR proposal consists of three pillars:

- Public and Multilateral Creditor Debt Reduction: The first pillar states that public and multilateral creditors must grant debt reductions substantial enough to restore fiscal stability and enable African countries to pursue climate and development objectives. MDBs must play a central role in these efforts, with mechanisms in place to ensure their financial stability and credit ratings.

- Private and Commercial Creditor Participation: Private and commercial creditors must be compelled to participate in debt relief efforts through a combination of incentives and penalties, ensuring fair comparability of treatment across all creditor classes.

- Credit Enhancements for Non-Distressed Countries: For countries that are not in immediate distress but that lack fiscal space, the third pillar foresees credit enhancements and other support mechanisms to reduce capital costs, attract investment and maintain liquidity. These measures include guarantees for sovereign bond issuances and potential debt service suspensions, paired with long-term growth plans.

A window of opportunity: African leadership in 2025

The year 2025 offers a unique opportunity for African leadership to drive the necessary reforms to address the debt crisis and accelerate green growth. With South Africa assuming the G20 Presidency, Uganda leading the G77 and the African Union now a permanent member of the G20, African nations are well-positioned to advocate for significant changes in the global financial architecture.

Key to these reforms is the integration of climate considerations into DSAs. Currently, DSAs primarily assess a country’s ability to repay debt, often overlooking the critical need for climate investments. By incorporating climate risks and opportunities into these assessments, the international community can ensure that debt relief efforts align with broader sustainable development goals.

African leaders must also push for comprehensive participation from all creditor classes in debt restructuring. Strengthening the principle of comparability of treatment will ensure that all creditors contribute fairly to the relief efforts, creating a more equitable and effective debt relief process.

Putting Policy into Action

Africa’s future hinges on its ability to overcome the intertwined challenges of debt and climate vulnerability. The DRGR Project’s proposal offers a comprehensive solution to these crises, but its success depends on strong leadership from African nations, support from the international community and extensive cooperation from private creditors.

As the world approaches critical climate milestones in 2025, the time for action is now. Africa must not only participate in global climate discussions but lead them, advocating for the debt relief and financial reforms necessary to secure a sustainable and resilient future for all.