Despite the precedent set by the Highly Indebted Poor Countries (HIPC) Initiative, the notion of involving multilateral development banks (MBDs) in debt relief continues to evoke skepticism and apprehension. DRGR Researcher Marina Zucker-Marques demystifies the topic of MDBs and debt relief, showing why their inclusion is not merely desirable but entirely achievable.

by Marina Zucker-Marques

At the recent International Monetary Fund (IMF)/World Bank Group Annual Meetings in Morocco, representatives of international financial institutions were again unable to agree on substantiative action to address the debt-climate crisis among emerging markets and developing economies (EMDEs).

One longstanding issue remains the lack of multilateral development bank (MDB) participation in debt relief negotiations. Indeed, despite the Group of 20 (G20) explicitly calling for MDBs to develop options to share the burden of debt relief efforts, they have as yet not agreed to contribute to debt relief efforts to countries applying for the G20 Common Framework.

A new report by the Debt Relief for a Green and Inclusive (DRGR) Project explains why MDBs must be included in debt relief efforts, estimates their fair share of the burden and explores policy options to fund their losses to preserve their high credit ratings.

Despite the precedent set by the Highly Indebted Poor Countries (HIPC) Initiative, the notion of involving MDBs in debt relief continues to evoke skepticism and apprehension. This blog post aims to demystify the topic of MDBs and debt relief, showing why their inclusion is not merely desirable but entirely achievable.

Why should MDBs be held responsible for absorbing losses when they are not the root cause of the crisis?

The current debt crisis is not solely attributable to the actions of individual creditors. Instead, it is a culmination of various factors, including economic disruptions brought about by the COVID-19 pandemic, monetary tightening in advanced economies, the scarcity of concessional loans and grants available to developing nations over an extended period and an upsurge in private lending with higher interest rates, among other contributing factors.

Participating in debt relief efforts does not equate to acknowledging culpability as a creditor. Rather, it represents a collaborative endeavor to assist a country in restoring debt sustainability and charting a course towards growth and development. To achieve this goal, countries in debt distress often require a substantial reduction in their debt burden, a feat that can frequently only be achieved when all creditors join in the debt relief negotiations.

Is MDB participation specifically aimed at engaging China in debt relief efforts?

The inclusion of MDBs in debt relief efforts serves a more comprehensive purpose than merely facilitating debt negotiations and involving all creditors, though that is undoubtedly important.

MDB participation in debt relief is fundamentally about achieving meaningful debt sustainability and enabling countries to invest in resilient, climate-positive projects. It encompasses the participation of all creditors while also advocating for a reformed Debt Sustainability Framework. Such a new framework would incorporate the investment needs defined by each country, particularly focusing on green and inclusive initiatives. It would also provide a more accurate assessment of the overall debt relief required to set countries on a sustainable development pathway.

Is MDB debt service a burden for developing countries? How many countries need debt relief from MDBs?

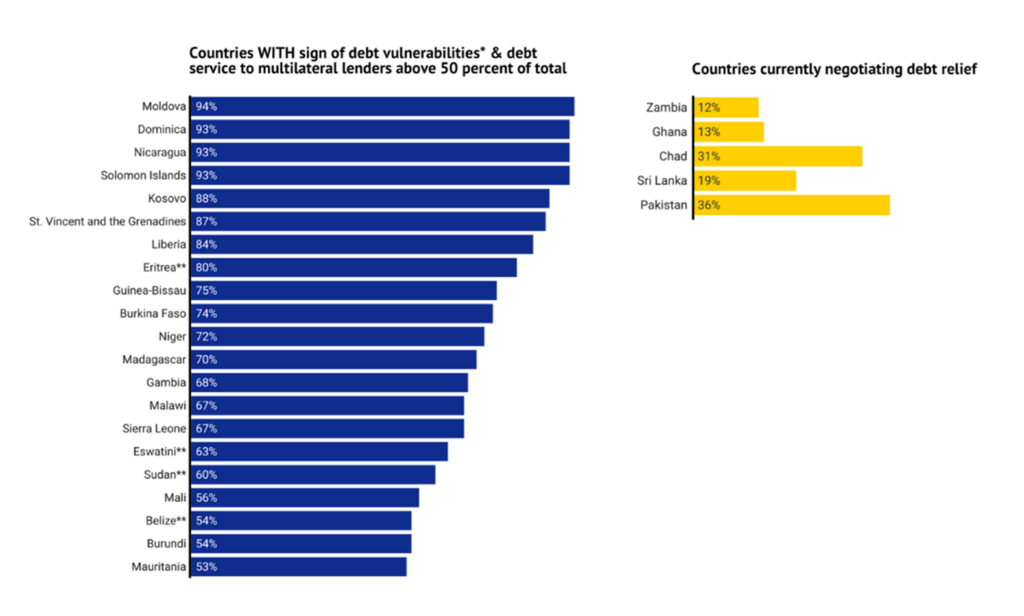

In our recent report, we observed that 27 countries exhibiting signs of debt vulnerabilities owe most of their external Public and Publicly Guaranteed (PPG) debt to multilateral lenders. Despite the lower interest rates typically offered by MDBs, 21 countries will see over half of their external sovereign debt service go to MDBs from 2023- 2029, as shown in Figure 1.

Figure 1: Average (2023-2029) debt service to multilateral lenders as share of external sovereign debt, by country group

While countries currently engaged in debt relief negotiations, as seen in Figure 1, may bear a relatively smaller debt service burden to multilateral lenders, it is crucial not to formulate overarching policies based solely on these limited cases. Currently, there are 73 countries eligible for the G20’s Common Framework, and there are calls for expanding this list. However, when policymakers make exceptions for certain creditor classes (like MDBs), they effectively reduce the pool of eligible countries that can seek debt treatment. After all, why would a government opt for a debt treatment mechanism if their primary creditor is, by default, excluded from participation? Therefore, when evaluating the involvement of MDBs in debt relief, it is imperative to consider the broader context beyond the cases currently under negotiation.

Should domestic debt restructuring take priority over external debt restructuring with MDBs’ participation?

Some might argue for the inclusion of domestic debt in restructuring negotiations, with MDBs’ external debt relief considered only as a last resort. Although the domestic debt service burden has increased for many developing countries in the last years, there are two important considerations on this point. First, balance of payment constraints and lack of access to foreign currency inflows have for a long time been understood as a critical impediment to development prospects. Therefore, prioritizing the restructuring of all external debt is essential. Second, it is crucial to recognize that domestic debt restructuring can have adverse spillover effects that further undermine economic stability and future growth prospects. As a result, prioritizing the restructuring of external PPG debt is paramount. For many countries, MDBs serve as their primary external creditors, underscoring the significance of including MDBs in debt restructuring efforts.

Would it be more effective for MDBs to provide more lending to countries with debt vulnerabilities? Why is it not enough that MDBs are participating in the Common Framework only with the “provision of net positive flows of concessional finance and grants”?

There are important trade-offs between debt haircuts and additional funding that must be decided in each case, these trade-offs can have varying implications depending on the size of debtor countries and their attractiveness to private investors. The “provision of net positive flows of concessional finance and grants” is not an adverse policy per se, and it can be financially equivalent to a haircut if the new financial flows are 100 percent grants. But if MDBs outright refuse the possibility of debt relief, some countries may be discouraged to pursue debt relief though they would benefit from it.

It is true that with more MDB funding (rather than debt haircuts), some critical projects could be financed at concessional terms. But it is important to bear in mind that lending from MDBs takes a long time to disburse. As World Bank Group President Ajay Banga noted during the 2023 Annual Meetings, World Bank projects can take an average of 27 months before financing is released, and that often it can be more than decade for economic benefits to be felt. Even turbulent debt negotiations under the Common Framework has seen faster outcomes. Additionally, once debt relief has been provided, countries have immediate fiscal space to spend on their priorities.

Moreover, if a country receives new funding from MDBs while in debt distress, it is likely that net concessional flows will be used to repay other official and private creditors that are not providing net flows. Typically, when countries are in a balanced position, concessional resources from multilateral lenders crowd in additional transfers, causing a positive spillover for growth and development. For these reasons, having a more open approach to how MDBs should be included in debt negotiations and include the possibility of a debt haircut can be beneficial to developing countries.

As the high concessionality of MDBs accounts for “ex ante” debt relief, why should they also participate in debt relief?

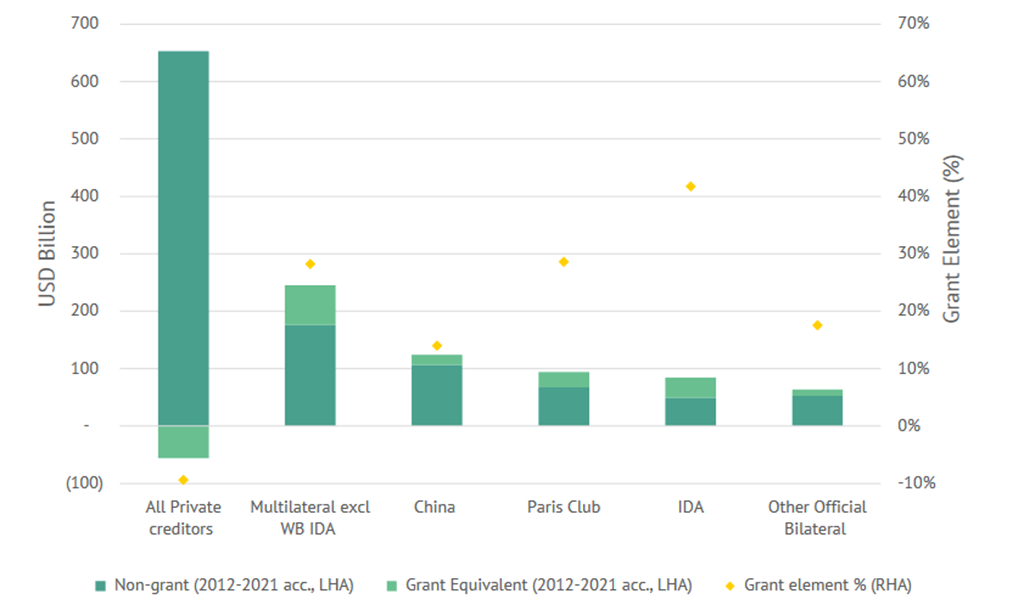

It is true that MDBs provide loans with high concessionally, essentially serving as an “ex ante” form of debt relief. However, the mere presence of concessional terms cannot be the sole criteria for creditor participation in debt relief efforts, otherwise many official creditors would need to be excused from debt relief efforts. As Figure 2 shows, all official creditor groups – including China – offer concessional lending, albeit to varying degrees.

Figure 2: Accumulated Loan Commitments and Grants (billion USD) and Average Grant Elements by Creditor Classes (%), Select Group of 61 Countries*, 2012-2021

Furthermore, considering the imperative of delivering substantial debt relief to countries grappling with debt distress, creditors may need to complement their efforts with “ex post” debt relief. This approach is essential to ensure that nations can attain a sustainable debt burden level, facilitating their path to economic recovery and development.

In our report, we adhere to a “fair” comparability of treatment rule, which acknowledges MDBs’ ‘ex ante’ debt relief initiatives and allocates additional ‘ex post’ debt relief to align their efforts with those of other creditor classes.

Would debt relief impact MDBs’ credit ratings?

No. MDBs are a key source of affordable finance for developing countries, and safeguarding their high credit ratings is vital. There are three policy options to support debt relief through MDBs that would not threaten their high credit rating and low cost of funding.

First, donor countries could contribute to new rounds of debt relief through mechanisms like the Debt Relief Trust Fund, which would pool resources from international financial institutions and donors, allowing for more comprehensive debt relief efforts. Moreover, they could allocate a dedicated portion of funding in each IDA replenishment for debt relief efforts to ensure a sustained focus on reducing the debt burden of developing nations.

A second avenue is a potential increase in MDB equity. By bolstering the equity of these institutions, a portion of precautionary balances could be made available for utilization in debt relief endeavors. This approach would not only provide additional resources for relief efforts, but also safeguard the institutions’ credit ratings.

Finally, the revival of international financial transaction tax (IFTT) discussions is worth considering. Although challenging from a political perspective, a well-designed IFTT applied to various financial transactions could yield substantial revenues. Redirecting these funds towards MDBs would not only support debt relief but also contribute to broader development goals.

Would debt relief jeopardize MDBs’ business model?

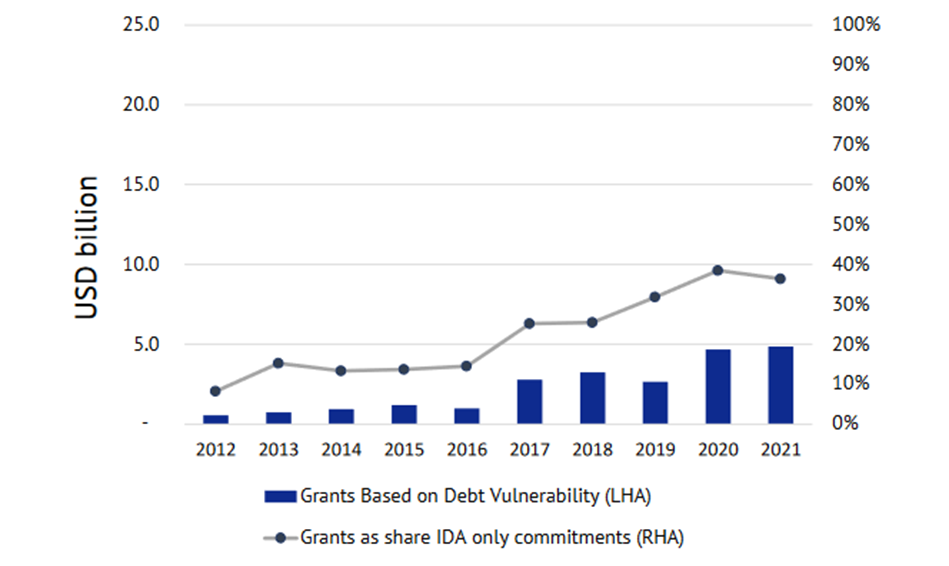

No, on the contrary, not only would the involvement of MDBs in debt relief not jeopardize their business model, but it could actually improve it. The concessional arms of MDBs consider the debt vulnerabilities indicators to assess the level of grants. For instance, the International Development Association (IDA, the concessional arm of the World Bank) adopts a “traffic light” system. Countries that are only eligible to borrow from IDA and are at high risk or in debt distress (red light) can benefit from 100 percent grants, medium-risk countries (yellow light) from 50 percent, while low-risk countries (green light) cannot benefit from grants and receive 100 percent IDA credit. This is a welcome policy to avoid debt overhangs for individual cases, but once debt crises become widespread – as they are now – a substantive number of countries become eligible for grants instead of affordable credits. Hence, MDBs are losing one of their funding sources – repayments from clients – and as a result, their total lending volume is compromised. We estimate that IDA grants based on debt sustainability criteria grew from $0.6 billion (8 percent of IDA-only commitments) to $4.9 billion (36 percent of IDA-only commitments) between 2012-2021, as shown in Figure 3. Therefore, helping countries achieve debt sustainability is not only beneficial for the countries themselves, but also for maintaining a balanced model for IDA and other MDBs that adopt similar concessional policies.

Figure 3: Grants Based on Debt Vulnerabilities Indicators, World Bank-IDA to IDA-only Countries, in USD billion, 2012-2021

How much debt relief would MDBs need to provide?

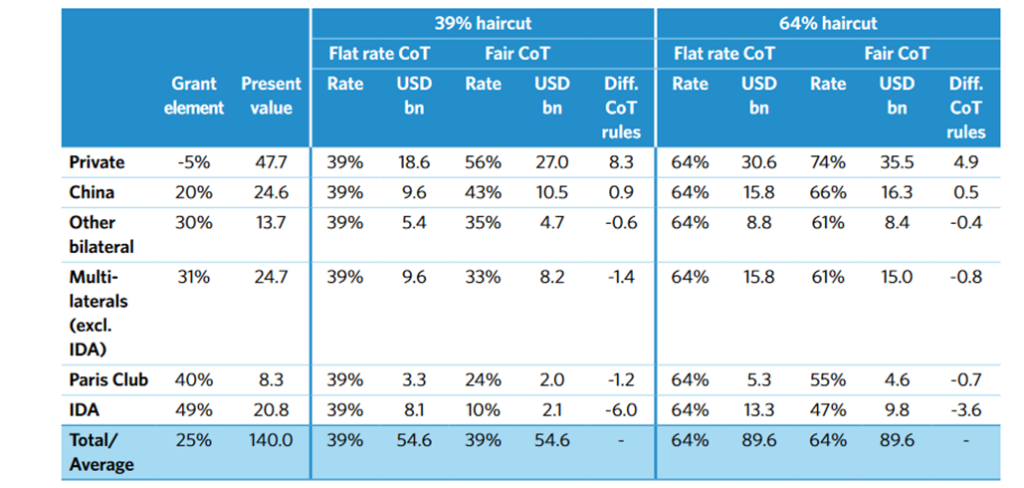

Debt relief efforts can come with substantial expenses. However, the benefits far outweigh the costs, and it is prudent to act sooner rather than later. For instance, when considering a “fair” comparability of treatment and focus debt relief on countries that are either IDA-only or Small Island Developing States (SIDS), the overall costs to MDBs, including IDA, would amount to approximately $10 billion for a general haircut of 39 percent (being $2.1 billion for IDA and $8.2 billion for other MDBs, see table 1). For a 64 percent debt reduction, as Table 1 shows, it would cost approximately $25 billion for all MDBs ($9.8 billion for IDA and $15 billion for other MDBs).

Table 1: 41 Countries (IDA-only eligible or SIDS) – Inter-creditor Burden Sharing According to “Flat Rate” and “Fair” Comparability of Treatment Rules

It is important to note that IDA already dedicates a considerable amount in grants connected to debt relief efforts. Providing debt relief can be especially advantageous in this context. With a 64 percent haircut, IDA would incur approximately $9.8 billion in losses under a fair comparability of treatment. Notably, IDA’s contribution to debt relief would be less than the grants it provided to debt-vulnerable countries from 2020-2021.

Furthermore, if the current situation of debt vulnerability persists among IDA-only countries, grants linked to debt vulnerability from IDA could accumulate to approximately $24.3 billion over the next five years, assuming a steady IDA lending volume. It is, therefore, more efficient for both debtors and creditors to proactively restructure debt now rather than prolonging an unsustainable situation.