Following the 2023 International Monetary Fund (IMF)/World Bank Group Annual Meetings in Marrakech, more details on the debt negotiation of Zambia and Suriname have surfaced. Among the intricate negotiations, one group appears to have emerged victorious, time and time again – bondholders.

by Marina Zucker-Marques

How, among a diverse group of creditors and complex financial pictures, have bondholders emerged from two separate debt restructuring negotiations with expected high returns on their new claims?

By examining Suriname’s and Zambia’s debt restructuring experiences with external bondholders, a pattern becomes clear, wherein bondholders pre-emptively charge high rates ahead of a developing country’s anticipated default, and yet do not bear substantial losses from debt restructuring. This dynamic not only unfairly burdens developing countries with high interest rates, but also risks creating a self-fulfilling prophecy where high interest burdens actually push sovereigns to default. Indeed, bondholders can be seen to triumph both before and after debt restructuring, while the countries negotiating their debt restructuring—and their citizens—wait in financial limbo.

Recently, Zambia’s Official Creditor Committee and the IMF expressed reservations over Zambia’s agreement with its bondholders, prompting Zambia to re-engage in discussions with bondholders and possibly reverse provisions of their deal.

Now is a crucial moment to start correcting a major flaw in the debt restructuring process. To start, not only must lending practices be revisited, but also minimum acceptable level of ‘haircut’ for bondholders must be set, considering their ‘ex ante’ higher lending costs. Additionally, the effectiveness of value recovery instruments (VRIs) should be reevaluated, as they presently only serve to amplify high returns. Moreover, effective arrangements are also needed to protect sovereigns from the risk of deteriorating future repayment capacity. Finally, the burden of delays in debt restructuring warrants a fairer distribution. Currently, debtors bear this burden alone. Implementing an automatic debt-standstill for countries in debt renegotiation could help balance this inequity.

Bondholders charge for “ex ante” default, but don’t assume “ex post” losses

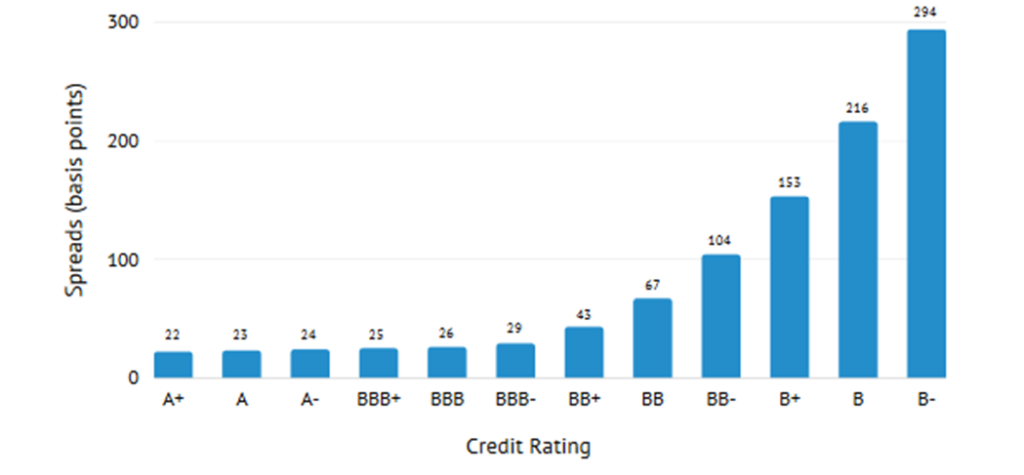

Before diving to the details on the deals, it is important to notice that bondholders price for default risk. According to estimations from Bank of America, for investment-grade countries, five-year spreads of about 20-30 basis points (bps) would be required to compensate for the historical probability of default, and it can reach 294 bps points for B- sovereign bonds, as shown in Figure 1.

Figure 1: Five-year Spreads (bps) to Compensate for Historical Probability of Default by Rating

However, charging for default risk does not translate into a proportional loss absorption in case of debt restructuring. Historically, private creditors – including bondholders – are typically paid first and lose less than bilateral official creditors who often provide concessional loans. As in the cases of Suriname and Zambia, even after debt restructuring, the remuneration of bondholders is far above the remuneration of risk-free assets like US Treasury bonds, meaning bondholders win out among creditors. If a country does not default, bondholders earn above risk-free assets, while if a country defaults and restructures, bondholders still stand to earn above risk-free assets.

Suriname’s debt situation

Suriname’s total public debt amounts to $3.3 billion, with $2.5 billion in external debt. The main external creditors of Suriname are multilateral organizations, including the IMF and multilateral development banks (MDBs), holding 38 percent of the debt. Despite the considerable amount of debt owed to MDBs, they have not been included in debt restructuring negotiations, although MDB debt relief is a safe and feasible policy. Followed by multilateral creditors, private bondholders account for 34 percent of Suriname’s debt, and official creditors, 26 percent. China is the largest official creditor to Suriname’s external debt, representing 15 percent of the total. As Suriname is classified as an upper-middle income country, it is not eligible for the G20 Common Framework and has negotiated with each creditor bilaterally.

Suriname and Eurobonds

Suriname has issued two Eurobonds. The first bond, issued in October 2016, amounted to $550 million with a 10-year maturity and a coupon rate of 9.85 percent. The second bond, issued in 2019, was worth $125 million (issued at a face value of 95 percent) with a four-year maturity and the same coupon rate. However, given the discount at issue and amortization in every payment date, the cash flow return of this bond is 18 percent annually, which is twice as high as the bond issued in 2016, as shown in Table 1.

Table 1: Cash Flow, Suriname’s Originally Scheduled Eurobond Payments in USD Million Versus US Anecdotal Comparison

| US comparison (anecdotical) | Suriname: Bond A | Suriname: Bond B | Total (bond A+ bond B) | |

| 2016 | 550.0 | 550.0 | 0.0 | 550.0 |

| 2017 | -9.8 | -50.9 | 0.0 | -50.9 |

| 2018 | -9.8 | -50.9 | 0.0 | -50.9 |

| 2019 | -9.8 | -50.9 | 118.8 | 67.9 |

| 2020 | -9.8 | -50.9 | -42.3 | -93.2 |

| 2021 | -9.8 | -50.9 | -42.3 | -93.2 |

| 2022 | -9.8 | -50.9 | -42.3 | -93.2 |

| 2023 | -9.8 | -50.9 | -42.3 | -93.2 |

| 2024 | -9.8 | -50.9 | 0.0 | -50.9 |

| 2025 | -9.8 | -50.9 | 0.0 | -50.9 |

| 2026 | -559.8 | -550.0 | 0.0 | -550.0 |

| Annualized rate of cash flow return | 1.8% | 8.8% | 18.0% | 9.3% |

| Accumulated for 10y | 119.5% | 233.1% | 243.5% |

In 2016, global interest rates were substantially lower. To put it in perspective, if the US Treasury has issued a 10-year bond on the same day that Suriname did (October 26, 2016), they would have paid just 1.79 percent per year. This means that, if the US has issued a bond in a similar amount ($550 million), they would have paid a coupon of $9.8 million per year. Suriname – a developing country with undoubtedly lower capacity to service its debt and with higher social priorities to spend – had to pay $50.9 million per year. With such harsh financial conditions, it comes as no surprise Suriname defaulted in April 2021. Charging such high interest rates can push countries to default, serving as a self-fulfilling prophecy.

Naturally, without a default, bondholders would have profited tremendously. In 2016, if a bondholder decided to purchase $100 in US Treasury bills, 10 years later they would have received almost $120. If they had chosen to purchase Suriname’s 10-year note instead, the same $100 investment would return $233 in 2026, as seen in Table 1. With the 2021 default, bondholders had a nominal loss of 32 percent on the 2016 bonds, and a nominal loss of 82 percent for the 2019 bonds.

Suriname’s bonds, with their significantly higher coupon rates, reflected the country’s credit rating, which stood at B+ in 2016, according to Fitch Ratings. In theory, bondholders charge high-interest rates to compensate for the risk of default, which did indeed occur in 2021. But even with Suriname’s default, bondholders’ expected returns would be as high as if the country had not defaulted. What is more, bondholders’ returns will be way above what they would have earned if they had invested in US Treasury bonds instead.

Crunching the numbers of Suriname’s deal

After three protracted years of debt negotiations, Suriname reached an agreement with bondholders to exchange the old bonds (originally maturing in 2023 and 2026) for new ones. In theory, bondholders are providing a 25 percent nominal haircut, but the inclusion of arrears in the calculation eliminates the cost of any real haircut. Under the terms of this agreement, the old bonds with a total nominal value of $668 million, will be exchanged for new bonds totalling $660 million ($650 million for the bonds and an additional $10 million in fees). Meaning, in practice, the bond exchange is providing just $8 million in a real nominal haircut, or 1.2 percent of the original bond issuance. The inclusion of arrears in the debt exchange means that Suriname alone carried the burden of a delayed restructuring, although Suriname is certainly not the only party responsible for such a prolonged process.

The new bonds will come with an extended maturity date of 2033 and an interest rate of 7.95 percent. Notably, between 2024-2025, bondholders will receive 4.95 percent of this interest in cash, while the remaining portion will be capitalized and paid out at maturity. This repayment scheme can provide Suriname some breathing space for the next couple of years, but looking at the whole picture, the cost of the Eurobond issuance has become remarkably high, particularly for a country grappling with external liquidity challenges. As Table 2 shows, considering the whole cashflow from the 2016 issuance until 2033, and including three years of default, Suriname will still pay over 7 percent interest per year even after their debt “relief” program. While this is below the contracted 8.8 percent per year, it will remain a high burden for a country still recovering from the COVID-19 pandemic and a myriad of development and climate change challenges. The particulars of this deal are also interesting, considering that what would likely be considered an unsuccessful investment from investors’ point of view somehow still yields a 7.1 percent return per year to its investors.

Additionally, Suriname’s deal with bondholders includes a Value Recovery Instrument (VRI) – a financial tool that provides additional returns if some agreed conditions are met – contingent upon a new revenue stream generated from a specific oil development project that bondholders have not contributed to. If the project is successful, Suriname will pay an additional $315 million to bondholders, which will increase the bond yield from 7.1 percent per year to 8.4 percent per year, as shown in Table 2.

Table 2: Suriname’s Eurobond Cashflows, USD Million, After Restructuring

| W/o Value Recovery Instrument | W/ Value Recovery Instrument | ||

| 2016 | Paid | 550.0 | 550.0 |

| 2017 | Paid | -50.9 | -50.9 |

| 2018 | Paid | -50.9 | -50.9 |

| 2019 | Paid | 67.9 | 67.9 |

| 2020 | Paid | -46.6 | -46.6 |

| 2021 | Default Apr | 0.0 | 0.0 |

| 2022 | Default | 0.0 | 0.0 |

| 2023 | Default | 0.0 | 0.0 |

| 2024 | Bond exchange | -32.7 | -32.7 |

| 2025 | Bond exchange | -32.7 | -32.7 |

| 2026 | Bond exchange | -32.7 | -32.7 |

| 2027 | Bond exchange | -52.5 | -52.5 |

| 2028 | Bond exchange | -52.5 | -52.5 |

| 2029 | Bond exchange | -52.5 | -52.5 |

| 2030 | Bond exchange | -52.5 | -52.5 |

| 2031 | Bond exchange | -52.5 | -52.5 |

| 2032 | Bond exchange | -52.5 | -52.5 |

| 2033 | Bond exchange | -941.0 | -1255.6 |

| Annualized rate of cash flow return | 7.1% | 8.4% | |

| Accumulated for 18y | 344.0% | 411.2% |

Not only are the returns higher when a VRI is included, but it could be a harbinger of concerning liquidity risks for Suriname. An individual oil project is unlikely to change the country’s structural problems, so the VRI does not reflect the actual debt servicing capacity of Suriname’s economy in 2033. Mozambique’s bond exchange with similar VRI connected to gas production should be a cautionary tale for Suriname. For Mozambique, although higher coupon obligation was triggered, delays in gas production did not increase government revenues as expected. Hence, Mozambique ended up using valuable foreign reserves to pay a higher interest rate to bondholders. This shows that, if a VRI is to be agreed, they should be tied to actual government repayment capacity. Finally, the deal with bondholders offers protection only to bondholders and not to the sovereign. If, in the upcoming year, Suriname’s external debt capacity deteriorates (for reasons beyond their control), there is no provision to alleviate debt service obligations – not even temporarily.

Despite undergoing debt restructuring, Suriname’s bonds are set to offer significantly higher returns compared to risk-free assets such as US Treasury bonds. If the 2 percent annual return of US Treasury bonds is extrapolated up to 2033, an investor who acquired this asset in 2016 would have received a total cash flow of $141 for their $100 investment. However, following the restructuring, and excluding the VRI, Suriname is poised to deliver a total cash flow of $332 for every $100 borrowed. Taking the VRI into account (which is linked to the exploration of a project to which bondholders did not contribute), the total return would be $411 over the entire period.

The question arises: What would constitute a fair haircut for bondholders while ensuring debt sustainability for the sovereign? To align with the returns expected from a risk-free investment as of the date of Suriname’s bond issuance (approximately a 2 percent yearly return), bondholders would need to accept a haircut of at least 52 percent. Instead of Suriname paying $660 million for the new bond, they would pay $315 million upon maturity. This adjustment would compensate bondholders for their opportunity cost, considering they could have invested in a risk-free asset back in 2016.

Zambia’s debt situation

Zambia’s public and publicly guaranteed (PPG) external debt in foreign currency totals approximately $18 billion. Of this, $3.5 billion is owed to multilateral creditors, which are currently not part of the restructuring negotiations. The country owes $6.3 billion, to official bilateral creditors, with the majority — $4.2 billion — due to China. Additionally, Zambia has $3.5 billion in obligations to Eurobond holders, $3.2 billion to commercial creditors and another $1.7 billion in arrears to various commercial entities.

In addition to its external debt, Zambia is also contending with $15 billion in domestic debt denominated in local currency. Within this domestic-currency denominated debt, $2.6 billion is held by non-resident creditors and as such, is technically considered external debt. Restructuring domestic debt posed a complex and sensitive issue regarding the impact of financial stability, leading official creditors to agree that domestic debt is outside the restructuring parameter. Therefore, this analysis centers on the restructuring of Zambia’s foreign-currency-denominated external debt.

Zambia and Eurobonds

Zambia issued three Eurobonds totalling $3 billion, starting with a $750 million bond at 5.37 percent interest in 2012, followed by a $1 billion bond at 8.5 percent in 2014 and a $1.25 billion bond at 8.97 percent in 2015. The first two bonds had 10-year maturities, and the last had a 12-year maturity.

Table 3: Cash Flow, Zambia’s Originally Scheduled Eurobond Payments in USD Million Versus US Anecdotal Comparison

| Zambia: Bond A | Zambia: Bond B | Zambia: bond C | Total | US comparison (Anecdotical) Bond A+C | |

| 2012 | 750.0 | – | – | 750.0 | 750.0 |

| 2013 | (40.3) | – | – | (40.3) | (13.5) |

| 2014 | (40.3) | 957.5 | – | 917.2 | 973.3 |

| 2015 | (40.3) | (85.0) | 1,250.0 | 1,124.7 | 1,210.0 |

| 2016 | (40.3) | (85.0) | (112.1) | (237.4) | (69.5) |

| 2017 | (40.3) | (85.0) | (112.1) | (237.4) | (69.5) |

| 2018 | (40.3) | (85.0) | (112.1) | (237.4) | (69.5) |

| 2019 | (40.3) | (85.0) | (112.1) | (237.4) | (69.5) |

| 2020 | (40.3) | (85.0) | (112.1) | (237.4) | (69.5) |

| 2021 | (40.3) | (85.0) | (112.1) | (237.4) | (69.5) |

| 2022 | (790.3) | (85.0) | (112.1) | (987.4) | (819.5) |

| 2023 | – | (85.0) | (112.1) | (197.1) | (56.0) |

| 2024 | – | (1,042.5) | (112.1) | (1,154.6) | (1,042.8) |

| 2025 | – | – | (112.1) | (112.1) | (29.5) |

| 2026 | – | – | (112.1) | (112.1) | (29.5) |

| 2027 | – | – | (1,362.1) | (1,362.1) | (1,279.5) |

| Annualized rate of cash flow return | 5.4% | 8.7% | 9.2% | 8.0% | 2.3% |

| Accumulated for the period | 169.8% | 229.7% | 286.4% | 341.9% | 144.5% |

Combining the cash flow of the three bonds, Zambia has been paying on average 8 percent to raise capital, while the US would pay on average 2.3 percent per year in the same period. Consider the different borrowing terms and the impact on debt service. From 2016-2020, when Zambia defaulted, it was scheduled to pay $237.4 million per year alone on the interest rate to Eurobond holders. If Zambia could borrow in similar terms to the US, it would have paid $69.5 million, or $167 million less. For context, this difference is more than what Zambia received via personal remittances in 2020 ($134 million).

Crunching the numbers on Zambia’s deal

In October 2020, Zambia defaulted on its Eurobonds, and debt restructuring took roughly three years. Like Suriname, the delay of the negotiation cost Zambia dearly, making the total outstanding claim increase from $3 billion to $3.82 billion. Even a 18 percent nominal haircut was insufficient to cover accumulated arrears and Zambia’s new bonds are $3.135 billion instead of the original $3 billion.

The structuring agreement was based on two possible future scenarios: “base case” and an “upside case,” which depended on whether Zambia’s carrying capacity assessment conducted by the IMF and the World Bank is seen to have improved. The deal also accounts for two different bonds, bond A with $2 billion in face value and bond B with $1.135 billion in face value. Only bond B is subject to changes in payment conditions under an upside case, which would trigger an accelerated payment schedule and higher interest rates. Again, similarly to Suriname, Zambia has no protection for a “downside case,” meaning that there is no provision for easy repayment obligations if Zambia’s repayment capacity deteriorates.

As Table 4 shows, under a base case treatment, the total cashflow for Zambia, including previously paid debt service would be a 4.4 percent per year, and obligations would be paid until 2053. In case Zambia’s payment capacity assessment improves, the yearly return will increase to 5.8 percent and the maturity would be shortened to 2035. In terms of cashflow return, the terms of Zambia’s restructuring deal could be considered better than Suriname’s; however, bondholders are still set to receive a high positive annual return, even after restructuring.

Table 4: Zambia’s Eurobond Cashflows, USD Million, After Restructuring

| Year | “Base Case” | “Upside Case” | |

| 2012 | Paid | 750.0 | 750.0 |

| 2013 | Paid | -40.3 | -40.3 |

| 2014 | Paid | 917.2 | 917.2 |

| 2015 | Paid | 1124.7 | 1124.7 |

| 2016 | Paid | -237.4 | -237.4 |

| 2017 | Paid | -237.4 | -237.4 |

| 2018 | Paid | -237.4 | -237.4 |

| 2019 | Paid | -237.4 | -237.4 |

| 2020 | Paid | -118.7 | -118.7 |

| 2021 | Default | 0.0 | 0.0 |

| 2022 | Default | 0.0 | 0.0 |

| 2023 | Bond exchange | -30.0 | -30.0 |

| 2024 | Bond exchange | -336.6 | -336.6 |

| 2025 | Bond exchange | -408.0 | -408.0 |

| 2026 | Bond exchange | -124.6 | -153.0 |

| 2027 | Bond exchange | -122.9 | -179.6 |

| 2028 | Bond exchange | -121.1 | -177.9 |

| 2029 | Bond exchange | -119.4 | -176.2 |

| 2030 | Bond exchange | -117.7 | -174.4 |

| 2031 | Bond exchange | -115.5 | -183.6 |

| 2032 | Bond exchange | -437.1 | -800.3 |

| 2033 | Bond exchange | -411.3 | -751.8 |

| 2034 | Bond exchange | -385.5 | -703.3 |

| 2035 | Bond exchange | -359.7 | -654.8 |

| 2036 | Bond exchange | -11.4 | 0.0 |

| 2037 | Bond exchange | -11.4 | 0.0 |

| 2038 | Bond exchange | -11.4 | 0.0 |

| 2039 | Bond exchange | -11.4 | 0.0 |

| 2040 | Bond exchange | -11.4 | 0.0 |

| 2041 | Bond exchange | -11.4 | 0.0 |

| 2042 | Bond exchange | -11.4 | 0.0 |

| 2043 | Bond exchange | -11.4 | 0.0 |

| 2044 | Bond exchange | -11.4 | 0.0 |

| 2045 | Bond exchange | -11.4 | 0.0 |

| 2046 | Bond exchange | -11.4 | 0.0 |

| 2047 | Bond exchange | -11.4 | 0.0 |

| 2048 | Bond exchange | -11.4 | 0.0 |

| 2049 | Bond exchange | -11.4 | 0.0 |

| 2050 | Bond exchange | -11.4 | 0.0 |

| 2051 | Bond exchange | -385.9 | 0.0 |

| 2052 | Bond exchange | -384.0 | 0.0 |

| 2053 | Bond exchange | -380.2 | 0.0 |

| Annualized rate of cash flow return | 4.4% | 5.8% |

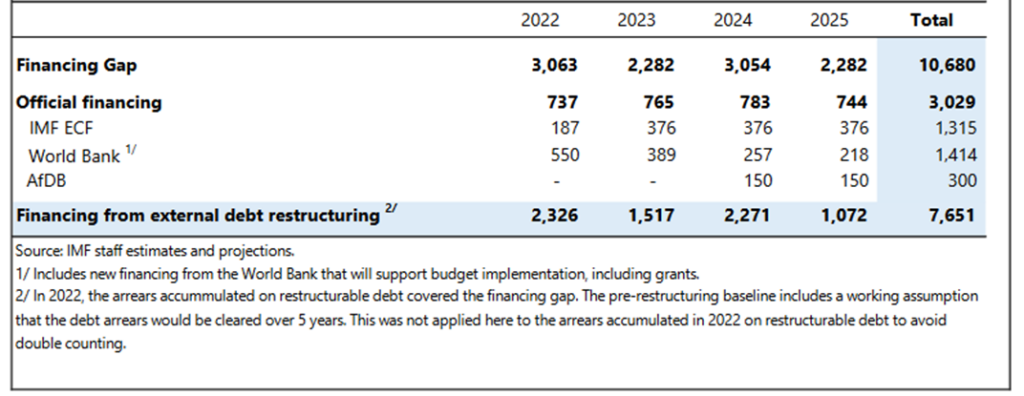

Concomitantly, because Zambia’s restructuring deal includes amortization in 2024 and 2025 (instead of only in the maturity date), it is draining all resources offered by the IMF during Zambia’s restructuring phase. More concretely, as Figure 2 shows, in 2024, Zambia will receive $376 million from the IMF, but it will pay $336 million to bondholders including interest rate and amortization. In 2025, IMF resources will not be enough to cover payments to bondholders, as Zambia will receive $376 million from the IMF but will need to pay $407 million to bondholders.

Figure 2: Zambia, Proposed Program Financing, USD Million

At present, there is uncertainty about whether the agreement with bondholders will actually materialize, as the IMF and the official creditor committee have expressed reservations about the preliminary agreement. While the specific reasons for these reservations remain unclear, an additional notable concern is the inconsistency between the terms offered to bondholders and those agreed upon with official creditors. The deal with bondholders proposes annual returns ranging from 4.4 percent to 5.8 percent, depending on the baseline scenario. In contrast, the agreement with official creditors entails an average extension of debt maturities by over 12 years, with interest rates fixed at 1 percent for the next 14 years, increasing up to 2.5 percent thereafter. In principle, the Paris Club has the authority to revoke a debt treatment if it finds that other creditors are not offering comparable terms. However, in practice, even though official creditors often provide more favorable terms than the private sector, there is no precedent of the Paris Club withdrawing a deal on the grounds of comparability treatment.

Learning from Zambia’s and Suriname’s experiences

In reviewing the experiences of Zambia and Suriname in their bond exchanges, several critical lessons on the nature and cost of debt restructuring are clear, including the need to rethink parameters for bondholders’ “haircuts,” reassess the role of VRIs and better share the risks and costs of debt restructuring among creditors and debtors.

The cases of these two countries are far from unique; they epitomize a broader system wherein private creditors position themselves as de facto senior to official lenders and impose high interest rates under the guise of risk compensation. Paradoxically, these creditors often avoid significant losses when debt is in fact restructured, prompting questions regarding the rationale for such steep rates in the first place.

This pattern of pre-emptively charging high rates for an anticipated default, yet not bearing substantial losses post-restructuring, not only risks creating a self-fulfilling prophecy of default by ‘risky’ sovereigns, but also unfairly burdens developing countries in two ways. Initially, these countries are hit with high interest rates, reflecting a perceived risk that may not be fully justified. Subsequently, they are often compelled to adopt austerity measures to service these debts, regardless of the economic or social costs involved. This double penalty – paying exorbitant interest rates followed by harsh fiscal policies – undermines the economic stability and growth prospects of these nations and raises a fundamental question of the equity and sustainability of such financial practices in international debt markets.

If bondholders emerge relatively unscathed during restructurings, continuing to reap returns above risk-free assets, how can such high interest rates be justified? It is time to rethink the norms of repayment and consider aligning the interest rates of emerging market and developing economies (EMDEs) with those of risk-free assets like US Treasury bonds. As the international financial architecture requires developing countries to repay their debts under any circumstance –with or without restructuring – their assets are much safer than often perceived and there are no grounds to charge large yields compared to so-called safe assets. This is not only a point to consider for new lending conditions, but also a way to rethink a benchmark for negotiating with bondholders. For instance, a minimum acceptable haircut for Suriname’s bonds should be 52 percent, which would align their return with US Treasury rates, rather than the provided 1.2 percent.

Moreover, the issue of bondholders profiting from projects they have not invested in needs to be addressed, such as Suriname’s oil ventures. This practice raises ethical and financial concerns about the legitimacy of such profits. More broadly, the role of VRIs also needs to be reconsidered, given that if VRIs serve to amplify bondholders’ returns, they risk exacerbating future debt crises and extracting resources from countries that urgently need to invest in social, climate and development priorities.

Another area of concern is the lack of protection for countries against downside risks beyond their control. Currently, the system is skewed towards increasing repayments without accommodating the possibility of a country’s declining repayment capacity. This one-sided approach could lead to severe financial crises down the line.

The unresolved issue of who shoulders the financial burden during prolonged debt negotiations is a critical one. It is inherently unfair for sovereign nations to be saddled with the full burden of interest arrears, particularly when they are not the ones causing delays in restructuring. A more equitable approach would be to distribute this cost between the sovereign and the creditors. In this context, implementing an automatic debt standstill, perhaps for a period of 18-24 months, could be a beneficial strategy. Under such an arrangement, the initial months would serve as an automatic period of ‘debt relief’ for the country undergoing debt treatment. Interest arrears would only begin to accumulate after this predetermined period. This policy would not only expedite the debt negotiation process, but also ensure a more balanced distribution of the financial burdens often incurred during these lengthy negotiations. By sharing these costs, all involved parties, and not just the debt distressed country, would bear a fair share of the financial responsibility.

The experiences of Zambia and Suriname warrant serious reflection for both creditors and debtors. For the numerous debtor countries — at least 69 by current counts — in dire need of debt restructuring, the message is discouragingly clear: avoid debt restructuring at all costs. The process is not only drawn out, but also lacks certainty that creditors, particularly private ones, will offer any meaningful debt relief. In fact, during this protracted process, debtor claims are likely to escalate, rather than diminish, as Zambia experienced. On the other side of the spectrum, bondholders are receiving a morally hazardous message: they bear no responsibility in their lending practices, and their returns will invariably be protected. This stance is not just perilous; it fundamentally undermines the principles of responsible lending and equitable risk-sharing in international finance.

Debt restructuring is a complex process and should not be seen as a win-lose game, but rather as a balanced, equitable solution for all stakeholders involved.