The lack of meaningful engagement from all creditor classes has undermined the effectiveness of the Group of 20’s Common Framework in providing significant debt relief. Our “Chart of the Week” shows why the role of multilateral development banks in particular deserves special attention.

by Sarah Ribbert and Arabella Wintermayr

A staggering 3.3 billion people reside in countries where external debt service now eclipses spending on public health or education.

External debt levels in emerging market and developing economies (EMDEs) have more than doubled since the 2008 global financial crisis, underscoring the need to address mounting debt pressures that hinder sustainable development, climate action and inequality alleviation efforts. Debt relief and restructuring is needed to create enough fiscal space for investments in shared climate and development goals.

Presently, existing restructuring initiatives under the Group of 20’s (G20) Common Framework (CF) have not gone far enough in several respects. Under the Common Framework, countries that have applied for debt restructuring have seen the process stretch on for years, hampering their economic recovery efforts. Furthermore, for many, restructuring would not provide enough fiscal space for the country to regain debt sustainability, let alone allow for critical investments in shared development and climate goals. Compounding these factors, research by the DRGR Project shows that the lack of meaningful engagement from all creditor classes, including private bondholders and multilateral development banks (MDBs), has also undermined the effectiveness of the Common Framework.

The role of MDBs in particular deserves special attention, given their role as a major creditor to many low-income countries that are debt distressed.

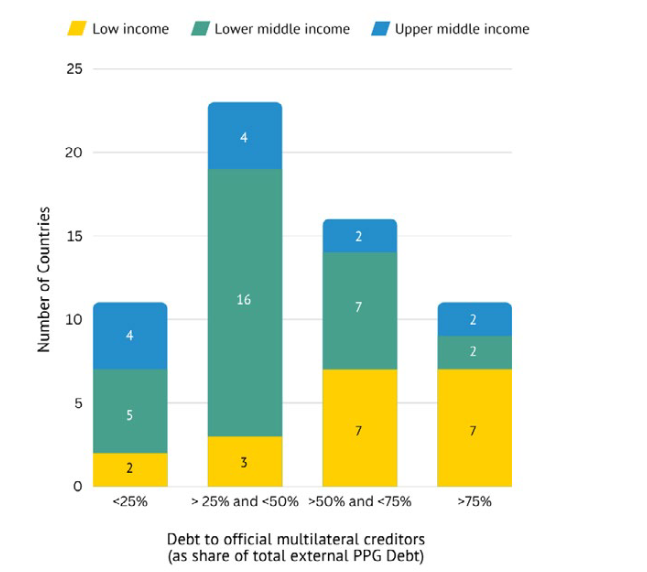

This Chart of the Week, taken from a DRGR Project report published in September 2023, illustrates the debt stock exposure of ‘New Common Framework’ countries to MDBs, by income group as a share of total official outstanding debt.

“Figure: Debt Stock Exposure to Official Multilateral Creditors as Share of Total Official Outstanding Debt, 2021. Number of countries by income group and size of exposure.”

While debt among EMDEs to MDBs is common, the amount can vary dramatically, especially by income level. Of 19 low-income countries (LICs) included in the sample, 14 owe more than 50 percent of their external debt stock to MDBs, and of these, seven owe more than 75 percent. Given these stark findings, it is clear that by excluding MDBs from debt restructuring, the poorest countries seeking restructuring would be unable to regain even debt sustainability, let alone entertain hopes of financing their climate and development goals.

The Global Sovereign Debt Roundtable (GSDR) has suggested that MDBs should engage in resolving the debt crisis by providing additional financing. While more affordable finance is welcome and needed, countries that are already experiencing debt distress will be restricted to take on additional debt, and could also be dissuaded from seeking relief under the Common Framework at all.

In conclusion, the imperative to reform the Common Framework cannot be overstated. By ensuring the participation of all creditors, including MDBs, the G20 can pave the way for more sustainable debt burdens among those least able to bear them.